Covered Calls and Cash Secured Puts (Part 28)

Posted by Mark on February 10, 2014 at 06:51 | Last modified: February 6, 2014 10:29Recall that MacDuff’s general philosophy is to raise cash with every trade. As my cash cushion continues to increase, eventually the stock will find a bottom and I will be able to exit the trade with a profit even if the stock has decreased over that time interval.

In the last post I showed a debit (i.e. cost money) adjustment and suggested the inclusion of the raised strike price when evaluating the adjustment. No I did not raise cash but raising the strike price to the stock’s current price essentially releases additional money, which is just as good as being paid.

I run into difficulty with this argument when considering a lowered strike price. A stock falling enough to require a lowered strike price (i.e. “rolling down”) to collect additional premium is what MacDuff terms an “Interim trade.” If I include the raised short call strike to the return calculation then would I also encounter instances where rolling down should factor in the lowered short strike to the calculation? If I did that then most Interim trades would be debit trades. For example:

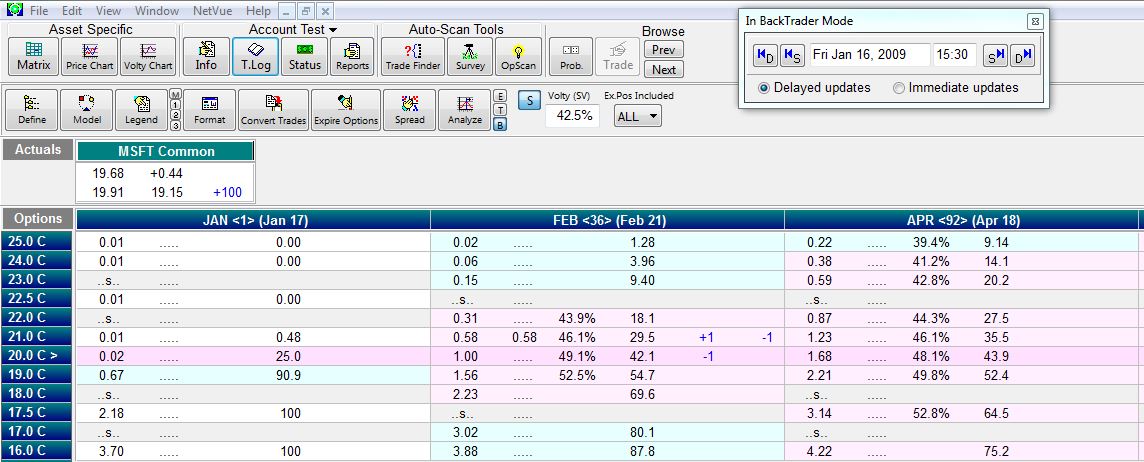

This adjustment buys to close the short Feb(36) 21 call and sells to open a Feb(36) 20 call. The net credit is $0.42. By lowering the strike price $1, though, I have an obligation to sell the stock for $1 less if I get assigned. Yes I brought in $42 by rolling down but I cost myself $100. This is a debit adjustment; why would MacDuff allow it?

Something seems amiss with this comparison. With the RO & Up adjustment, I changed expiration months. The time I sold allowed me to calculate an annualized return. Here I did not sell time and the return therefore cannot be annualized.

I think the resolution has to do with the mirror image thinking I discussed earlier. The comparison should not be between RO & Up and rolling down. The comparison should be between RO & up for a call and rolling down and out for a put.

I will continue this discussion next time.

Categories: Option Trading | Comments (2) | Permalink