Covered Calls and Cash Secured Puts (Part 26)

Posted by Mark on February 4, 2014 at 07:02 | Last modified: February 1, 2014 06:05I left off discussing the risk of compounding loss when using the RO & Up adjustment. Today I will illustrate with an example.

This CSP position begins on January 29, 2008, by selling a Jul(132) $32.50 put on MSFT (trading at $32.55) for $2.28. The credit received provides 7.21% of downside protection and a potential annualized return of 19.40%. This satisfies my variation of the Math Exercise, which is to accept at least 5% of downside protection rather than MacDuff’s 12-15%. I have encountered great difficulty finding stocks that meet the latter criterion in addition to the 15%+ annualized return.

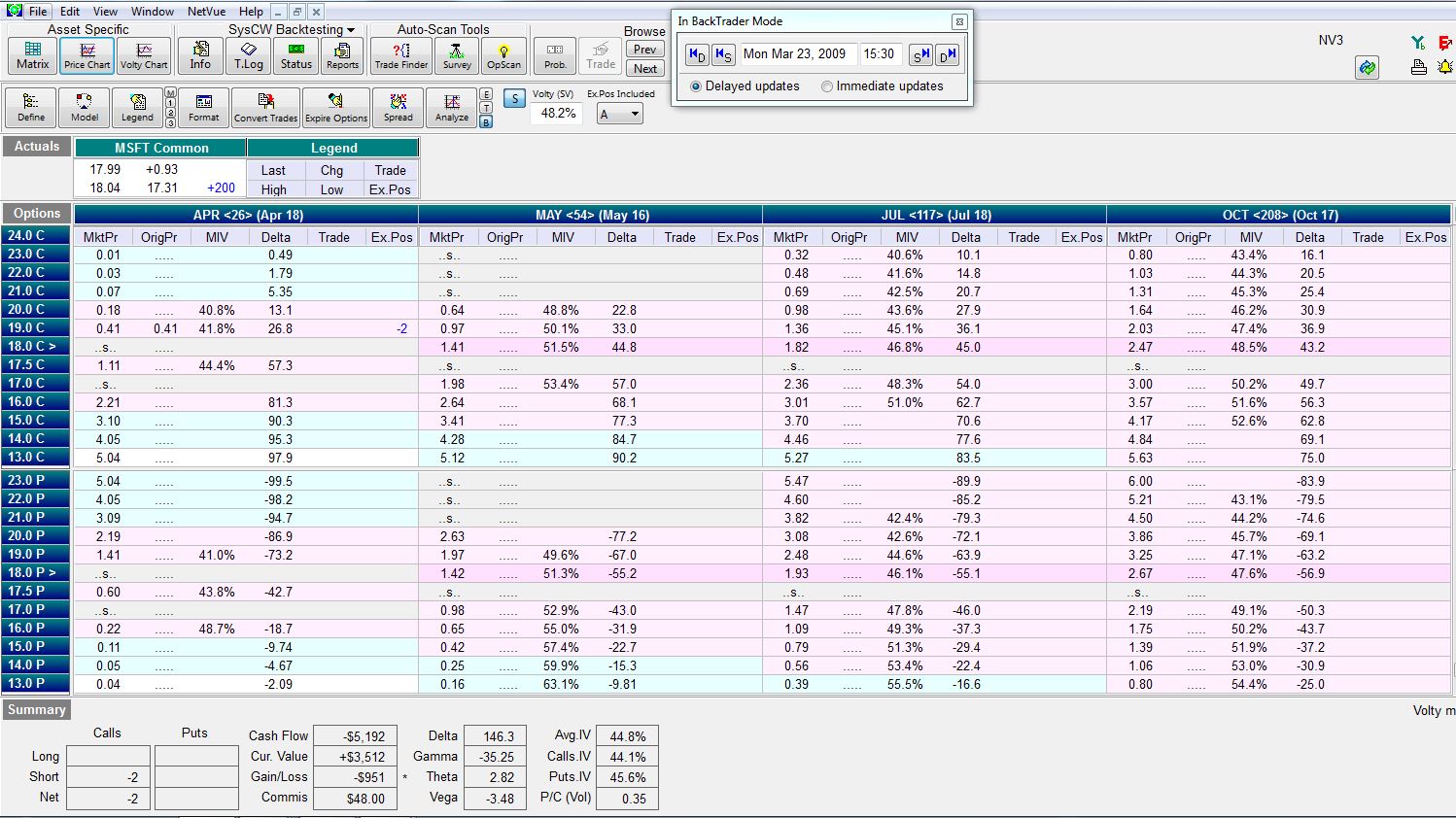

With the market in decline over the next 14 months, I took assignment of the shares and then sold CCs against the stock. I had to roll down three times through March 2009 expiration. On March 23, 2009, the stock chart looked like this:

On this day, I rolled down for a fourth time:

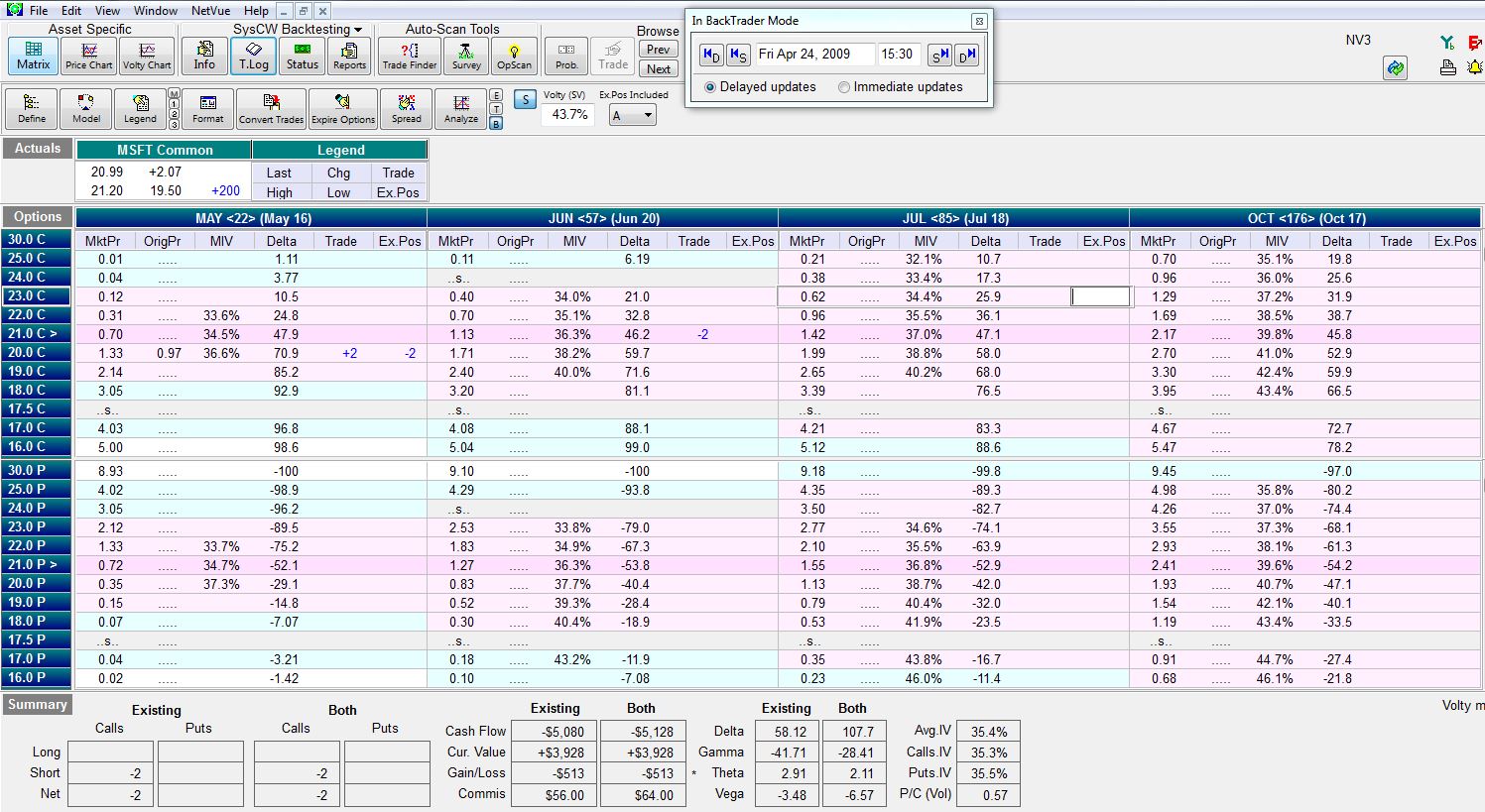

The stock had already found a bottom and over the next month, it moved sharply higher. On April 24, 2009, I made the following RO & Up adjustment:

The position is down $527 and I’m fighting to keep the short call OTM. With this trade, I bought back the May 20 call for $1.33 and sold the Jun 21 call for $1.11. I therefore spent money on this adjustment, which is a violation of the guidelines. Ideally I want to take in money with each adjustment at a 15% annualized rate of return or better.

What if I sold the Jul(85) $21 call for $1.42? The credit on this roll would have been $0.31. The annualized rate of return for this adjustment would have only been 6.87%, however.

What if I sold the Oct(176) $21 call for $2.17? The credit on this roll would have been $1.06 but the annualized return would have only been 9.62%. The longer-dated call would not decay as fast as the Jun or Jul call either. This means if the stock continued to rally then I could quickly run out of expiration months for rolling.

I will continue discussion of this example in my next post.

Categories: Backtesting, Option Trading | Comments (1) | Permalink