Covered Calls and Cash Secured Puts (Part 21)

Posted by Mark on January 7, 2014 at 07:39 | Last modified: January 28, 2014 06:50In the last post, I discussed “rolling out” as a strategy to manage the CC/CSP trade. Today I will begin discussion of a management strategy called “rolling down.”

Rich MacDuff runs a CC/CSP service called Systematic Covered Writing (SysCW). You may look at his content here. I recommend signing up to get his free educational content. One thing I am trying to determine is whether SysCW makes sense as a comprehensive approach to CC/CSP trading.

MacDuff’s guidelines to rolling down a CC:

1. Strike price of the replacement call must be lower than existing call

2. Trade must be done for a net credit

3. Strike price of replacement call must be higher than current stock price

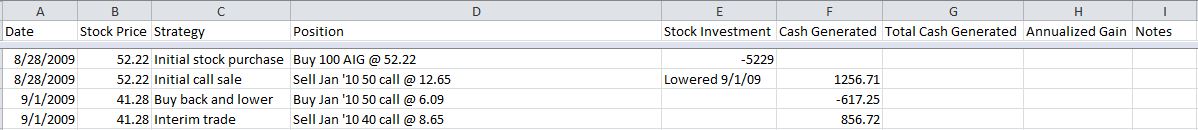

The following example of the rolling down strategy comes from MacDuff’s archives:

The stock dropped nearly 21% within days of placing the CC trade. Notice how the short call was rolled down from the $50 to the $40 strike for a net credit of $2.56.

Or was it?

The problem I have with this example is that MacDuff violated guideline #3: his replacement call was sold at a strike price below the current stock price. This means the replacement call is immediately ITM and at risk for being assigned.

Because the replacement call is ITM, part of the credit received on the roll may have to be given back. The Jan ’10 40 call has $1.28 of intrinsic value. Only if the stock falls to $40 or below at Jan ’10 expiration will I keep this $1.28. If the stock does nothing then I will realize only $1.28 of net profit from rolling the call down 10 points. That seems lousy.

On a positive note, thus far the trade has generated $1,496 on an investment of $5,229. If AIG is above $40 at Jan expiration then this trade will make $267, which is 5.1% in 20 weeks. AIG would have to rally 32.9% to match that 5.1% gain over the same time interval.

Guideline #3 exists because in many cases, assignment on a CC trade where the strike has been lowered can result in a loss. That is not the case here because the $1,496 generated thus far represents 28% of downside protection for the stock.

Selling premium against long stock makes good, logical sense.

Comments (3)

[…] the last post, aside from illustrating the “rolling down” management technique I introduced you to […]

[…] Two posts ago, I presented an example of the “rolling down” CC management technique from Rich MacDuff. I will now proceed by talking more about MacDuff’s general trading philosophy. […]

[…] have already discussed the CC/CSP management techniques of rolling out and rolling down. On the heels of a detour to cover certain aspects of Rich MacDuff’s SysCW investment […]