Covered Calls and Cash Secured Puts (Part 25)

Posted by Mark on January 30, 2014 at 07:15 | Last modified: January 31, 2014 09:19I previously explained the RO & Up adjustment strategy for CCs. In the last post I explained the analogous strategy for CSPs. Today I want to flush out the risk in these strategies especially with regard to Rich MacDuff’s philosophy.

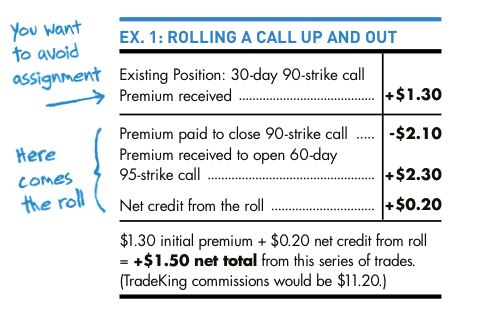

Here is another example of the RO & Up adjustment (courtesy of the TradeKing website):

Noted here are TradeKing’s commissions, which halve the $20 credit received for the adjustment. I recommend a brokerage that does not have a per trade [ticket] charge. Find a commission structure of $1.50/contract or less for small sized trades.

One maxim I hear repeated very often with regard to CCs is the following:

“If the stock moves through your short call strike then you can just RO & Up.”

People say this with confidence. They say it with simplicity… as if it the obvious course of action. Their nonchalance whispers, “it’s no big deal.”

I’m here to speak against every one of these people by saying it’s not always that easy.

Whenever I RO & Up, I may be taking a loss on the short call. Because the market still has time to move against me, I have secured no gains on the replacement call nor on stock appreciation. The future result could be compounding my losses.

Rather than rolling and feeling like I have just won the game, I should roll and immediately start planning what I will do next if the market moves against me again!

The worst case scenario involves the market rallying above my short call strike so fast that I scramble to find an option far enough out in time to recoup my loss and am unable to do so. In other words, no higher-strike call exists to sell for as much as my existing short call trades even in the most distant expiration month on the option chain.

Where are those nonchalant masters of the obvious now? They are not around to help me. That much is clear.

I will show an example of this in my next post.

Categories: Option Trading | Comments (1) | PermalinkCovered Calls and Cash Secured Puts (Part 24)

Posted by Mark on January 27, 2014 at 06:05 | Last modified: January 30, 2014 05:20In the last post I presented some critical thinking ideas that I watch for to avoid being scammed. Especially knowing MacDuff’s history, caveat emptor.

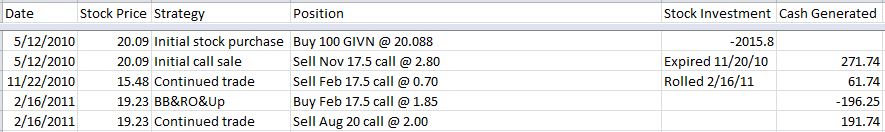

That detail aside, the example shown here does show assignment avoided and more time being enlisted to generate profit for the trade. Rolling the short call out and up (RO & up) from $17.50 to $20 with the stock at $19.23 allows for the opportunity to make an additional $250 on the position should the stock rally to $20 or higher at August expiration.

Before I proceed further, I want to discuss an occasional difference in thinking between CC and CSP trades.

This blog series began with explanation of why CC and CSP trades are synthetic equivalents.

While this is true, some nuances of the management techniques are different for CCs than they are for CSPs. Understanding these differences is generally about learning a “mirror image” way of thinking that I am trying to point out along the way. I first introduced this mirror image concept with the “loaded question” reference back in Part 17.

The parallel instance for RO & Up for an ITM CC would be rolling down and out for an ITM CSP. The former would occur in a bullish market whereas the latter would occur in a bearish market. The former generally raises profit potential on the trade whereas the latter generally reduces profit potential on the trade. Never would the two occur in the same trade.

Earlier in the blog series I purposely addressed “the CC/CSP trade” in most instances to imply interchangeability. Please accept this disclaimer as reason why I have switched to addressing just CCs or just CSPs since I started to discuss trade management techniques. Once again, while the management techniques can be done with either CCs or CSPs, they would never be interchangeable for any one given trade.

This matter will likely surface again as I go through additional examples in future posts.

Categories: Option Trading | Comments (2) | PermalinkCovered Calls and Cash Secured Puts (Part 22)

Posted by Mark on January 21, 2014 at 06:06 | Last modified: January 29, 2014 07:42I have already discussed the CC/CSP management techniques of rolling out and rolling down. On the heels of a detour to cover certain aspects of Rich MacDuff’s SysCW investment philosophy, today I will introduce the management technique of “rolling out and up.”

Rolling out and up (RO & Up) is a CC strategy very similar to rolling out. The goal is to delay assignment and to generate more income. This can augment an already-profitable position or avoid realization of a loss on a position that is not profitable.

The two guidelines for implementing this management technique are:

–Strike price of the replacement call must be higher than the existing option.

–Cash received from selling the replacement call must be greater than that required to buy back the existing option.

Here is an example from the MacDuff archives:

Look very closely. Do you see a problem here?

[Jeopardy theme song plays for 30 seconds]

Okay… what did you come up with?

One thing that may be strange is why the stock was purchased for $20.088/share and the total cost of 100 shares was $2,015.80. MacDuff does include supposed commissions and other transaction fees in his trade reporting. This also explains why the initial call sold for $2.80 only brings in $271.74 (this brokerage probably charges a ticket fee and a per-contract fee; $7.50/trade and $0.76/contract respectively, for example, would make these numbers work).

That’s not what I was thinking of, though.

Although the original call sold for $2.80, only $0.21 of that is extrinsic value. The annualized return on that would be:

(21 / 2015.80) * 100% * (365 days / 1 year) / (191 days) = 1.99% / year

This does not meet the criteria of MacDuff’s Math Exercise, which seeks at least 15% annualized. Were the stock trading above $17.50 at Nov expiration, up to $2.59 of the $2.80 would be subject to “give back” (MacDuff’s term). While intrinsic value may be sold, realizing that profit is conditional on the stock staying lower. The Math Exercise focuses on what can be expected if nothing changes since Nobody Knows in what direction the markets will move.

A bit more scrutiny–next… when we return.

Categories: Option Trading | Comments (2) | PermalinkThe Rich MacDuff Investment Philosophy (Part 3)

Posted by Mark on January 17, 2014 at 06:44 | Last modified: January 29, 2014 06:02In the last post, I delved into the basics of Rich MacDuff’s SysCW investment philosophy. Today I will continue detailing some of these principles.

MacDuff claims that someday the market will be higher than it is today. Such has always been the case through this point in history. CC/CSP investing is a long-term pursuit. We should not expect to make big money fast. We need to be patient and cope with the downtrends that occur from time to time.

MacDuff aims to never, ever realize a loss. If a stock falls then we can roll down. If the stock shoots back up then we can roll out or do other things to generate more cash and avoid assignment. MacDuff states that we never want to be assigned when the strike price is lower than the initial position strike price.

The goal of SysCW is to raise cash with every trade. MacDuff suggests that we should not focus on the current stock price: just our ability to sell premium against it.

By this way of thinking, stocks are like real estate holdings whose sole purpose is to generate rental income. As long as we continue to collect rent, we need not worry about the value of the buildings. We should be willing to own the property for the long term. The real estate market will have its pullbacks and declines but at some point it will be higher than it is right now. When that day comes, combined with the cumulative rental income we have been able to generate, we will be ready to sell with a solid return on total investment.

All of this certainly sounds great but as with life, everything in the investment world has its pros and cons. If I do not understand the cons then I have not done my due diligence.

In the next post, I will discuss the “rolling out and up” strategy along with some risks that cut to the heart of the “never take a loss” argument.

Categories: Option Trading | Comments (1) | PermalinkThe Rich MacDuff Investment Philosophy (Part 2)

Posted by Mark on January 14, 2014 at 07:58 | Last modified: January 29, 2014 06:01Two posts ago, I presented an example of the “rolling down” CC management technique from Rich MacDuff. I will now proceed by talking more about MacDuff’s general trading philosophy.

MacDuff’s book begins by stressing that Nobody Knows whether a stock will go up in value, go down, or trade sideways. He suggests that stock analysts are notorious for being wrong with their projections and they are the paid professionals who have more resources and technology at their fingertips than anyone else in the industry.

[Looking past the irony of a fraudster basically accusing others of fraud] I tend to agree with this claim and future posts will address this with regard to different categories within the financial industry. Nobody knows what will happen to a stock and that includes any professional or “service” that claims an ability to choose the right ones.

A corollary to the Nobody Knows principle is that no one stock is better than any other. MacDuff provides a stock checklist and suggests the most important thing is to be consistent with whatever criteria we choose to use. Be fully aware, too, that no matter what criteria we use, the stock may or may not go down: Nobody Knows, after all.

Another corollary to the Nobody Knows principle is that “money does not care what it owns.” Why, then, should the investor? We should look to stay diversified. We should trade numerous, small positions to limit the risk in case any one position goes bad. Trade in all sectors. Grow wealthy through increased stock holdings or positions rather than with any one specific stock.

Because Nobody Knows, rather than stock selection MacDuff insists the focus should be on every trade fulfilling the “Math Exercise.” Any proposed trade that fulfills the Math Exercise is good to go as a small trade. The guidelines (for CCs) are:

–Initial call option should produce a 12-15% cash return on the underlying stock.

–If assigned, a minimum 15% annualized return should be realized.

I will continue this discussion in the next post.

Categories: Option Trading | Comments (3) | PermalinkCovered Calls and Cash Secured Puts (Part 21)

Posted by Mark on January 7, 2014 at 07:39 | Last modified: January 28, 2014 06:50In the last post, I discussed “rolling out” as a strategy to manage the CC/CSP trade. Today I will begin discussion of a management strategy called “rolling down.”

Rich MacDuff runs a CC/CSP service called Systematic Covered Writing (SysCW). You may look at his content here. I recommend signing up to get his free educational content. One thing I am trying to determine is whether SysCW makes sense as a comprehensive approach to CC/CSP trading.

MacDuff’s guidelines to rolling down a CC:

1. Strike price of the replacement call must be lower than existing call

2. Trade must be done for a net credit

3. Strike price of replacement call must be higher than current stock price

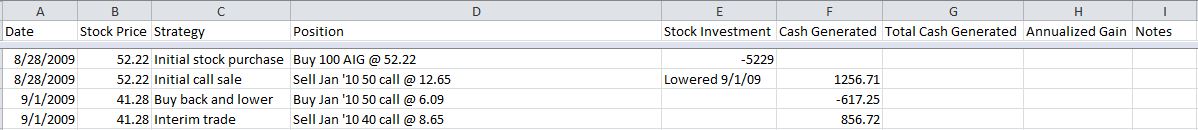

The following example of the rolling down strategy comes from MacDuff’s archives:

The stock dropped nearly 21% within days of placing the CC trade. Notice how the short call was rolled down from the $50 to the $40 strike for a net credit of $2.56.

Or was it?

The problem I have with this example is that MacDuff violated guideline #3: his replacement call was sold at a strike price below the current stock price. This means the replacement call is immediately ITM and at risk for being assigned.

Because the replacement call is ITM, part of the credit received on the roll may have to be given back. The Jan ’10 40 call has $1.28 of intrinsic value. Only if the stock falls to $40 or below at Jan ’10 expiration will I keep this $1.28. If the stock does nothing then I will realize only $1.28 of net profit from rolling the call down 10 points. That seems lousy.

On a positive note, thus far the trade has generated $1,496 on an investment of $5,229. If AIG is above $40 at Jan expiration then this trade will make $267, which is 5.1% in 20 weeks. AIG would have to rally 32.9% to match that 5.1% gain over the same time interval.

Guideline #3 exists because in many cases, assignment on a CC trade where the strike has been lowered can result in a loss. That is not the case here because the $1,496 generated thus far represents 28% of downside protection for the stock.

Selling premium against long stock makes good, logical sense.

Categories: Option Trading | Comments (3) | PermalinkCovered Calls and Cash Secured Puts (Part 20)

Posted by Mark on January 2, 2014 at 07:18 | Last modified: January 24, 2014 09:17In the last post of this blog series, I illustrated the adjustment technique of rolling out as a way to continue a CC/CSP trade. Rolling out may also be used to delay assignment or avoid assignment altogether.

The Part 19 example showed how rolling out may be used to continue a successful CC/CSP trade in a sideways market.

Rolling out may also be used if the market trades lower, thereby putting the CSP ITM. Recall that a short option is at risk for assignment when time value approaches zero. This typically occurs near expiration or when the option goes deep ITM. Rolling out refreshes the trade by closing an option with little time value remaining and opening one with more time value (read: profit potential!) remaining. The trade profits through time decay provided that intrinsic value decreases or remains constant.

Rolling out provides more time for the position to work in my favor. An ITM CSP approaching expiration becomes a longer-dated ITM CSP after rolling out. The position continues to be ITM and this often makes traders uncomfortable. I now have more time for the market to reverse and turn higher, though. If the stock price has rallied above the short strike at the new expiration date then the CSP will expire worthless and I will realize total profit without ever being assigned.

If I don’t want to roll out when my CSP goes ITM then I can take assignment. This is not a bad outcome because by definition, I have cash available in my account to purchase the stock. I can then continue the trade by selling a CC against it. Since this is a synthetically-equivalent trade to the CSP, the choice is yours.

One reason to prefer the CC over CSP might be dividends. I will address this point in a later post.

Categories: Option Trading | Comments (0) | Permalink