Covered Calls and Cash Secured Puts (Part 16)

Posted by Mark on December 17, 2013 at 03:04 | Last modified: January 22, 2014 03:50As you can read about here and here, I have recently been writing about tradeoffs to consider before placing a CC/CSP trade. Today I will begin to discuss management of winning trades.

As mentioned here, the CC/CSP trade is bullish and one possibility of how to manage a winner is to do absolutely nothing. In the case of a CC, the short call gets assigned and my stock gets sold. I will likely have to pay an exercise/assignment fee that should be factored into the plan before trade inception. In the case of a CSP, the short put will expire worthless and I will be “back to cash” with whatever margin requirement was originally committed to establish the position.

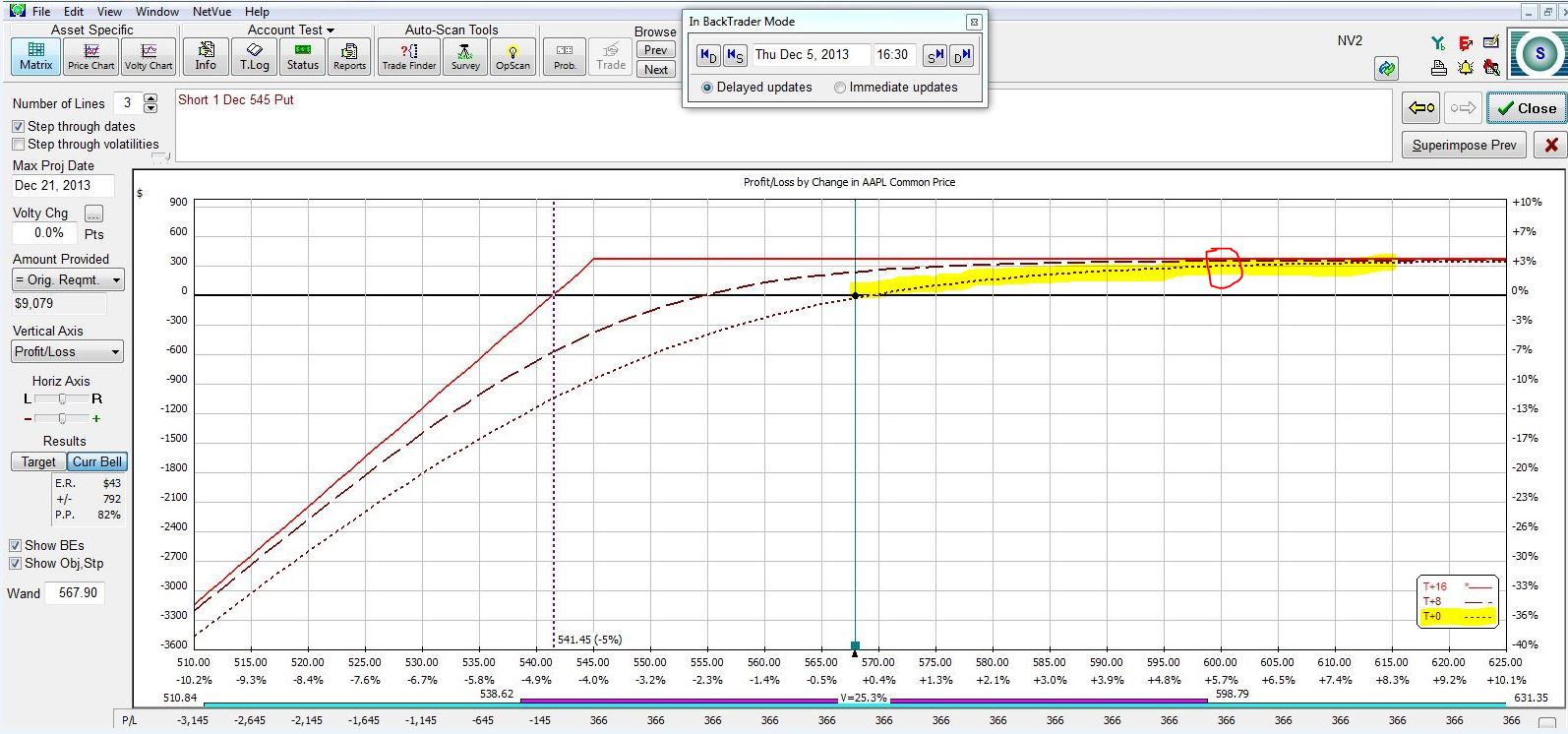

If I want to actively manage winners then I could opt to close the trade early. Revisiting a risk graph from a few posts ago:

If AAPL jumps to $600/share today, then notice how the lower dotted line (T+0 curve) has climbed nearly to the solid, expiration curve. In one day, the trade has made $319 out of a possible $366. Is it worthwhile for me to hold the position another 15 days to make the remaining $47?

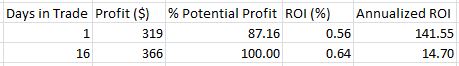

In tabular form, the decision looks like this:

I believe this makes a strong case for closing the trade early. If I could do this on a regular basis and make 141%/year on every trade then I’d be a very successful trader.

In addition to boosting returns, another reason to close winning trades early is to protect both profits and mental stability. If I were up 87% of my potential profit after a few days and the market reversed to land me with a loss after 16 days then I would be angry, depressed, downtrodden, etc. Is it really worth losing everything (and possibly more) to make the final 13% on the trade? I used to think so until it happened a few times. I have since changed my tune.

Next time I will begin discussion on what to do when the market goes against me.

Categories: Option Trading | Comments (1) | Permalink