Covered Calls and Cash Secured Puts (Part 14)

Posted by Mark on December 9, 2013 at 05:22 | Last modified: January 21, 2014 12:09In my last post, I discussed differences in moneyness with regard to the short option. I also introduced the concept of “downside protection.”

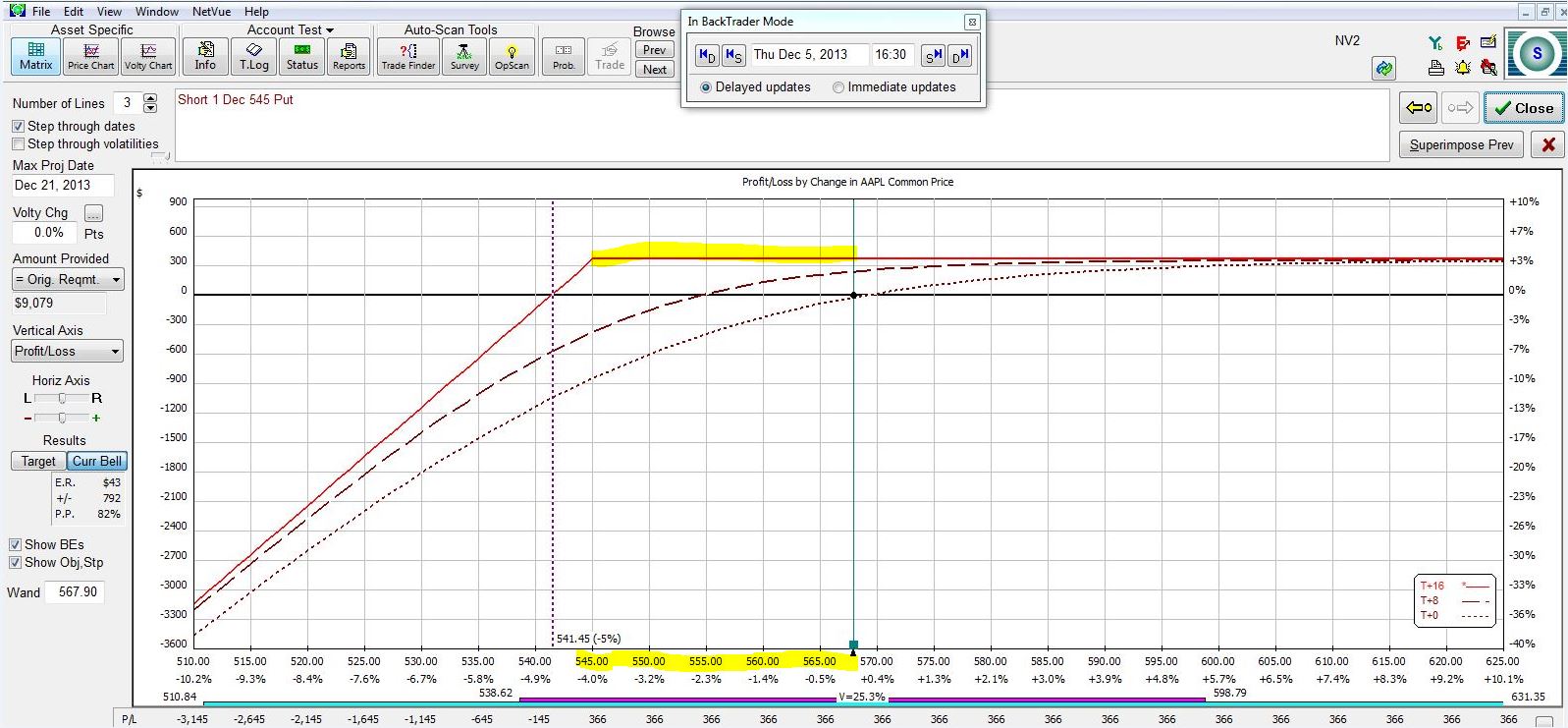

With AAPL having closed at $567.90, recall the risk graph of the 545 put:

The expiration curve (highlighted) is the PnL at option expiration, which is 16 days into the future. Note how the stock can fall in price yet the CSP position still posts full profit. The put strike price of $545 means the option will expire worthless if AAPL is above $545 at expiration. In order to lose money, the stock must fall even farther to offset the money collected from the put sale. The total downside protection is therefore about $26.40.

Not having to be correct about market direction represents a great advantage to trading CC/CSPs rather than long stock. Sixteen days from now, if AAPL stock has fallen no lower than $545 then the stock position loses money while the CC/CSP position makes full profit. In a previous post I discussed a roaring bull market as disadvantageous to CC/CSP trading because the CC/CSP underperforms with its full profit. Is this disappointment more than offset by how good CC/CSP traders feel when the market declines and these positions still generate that full profit?

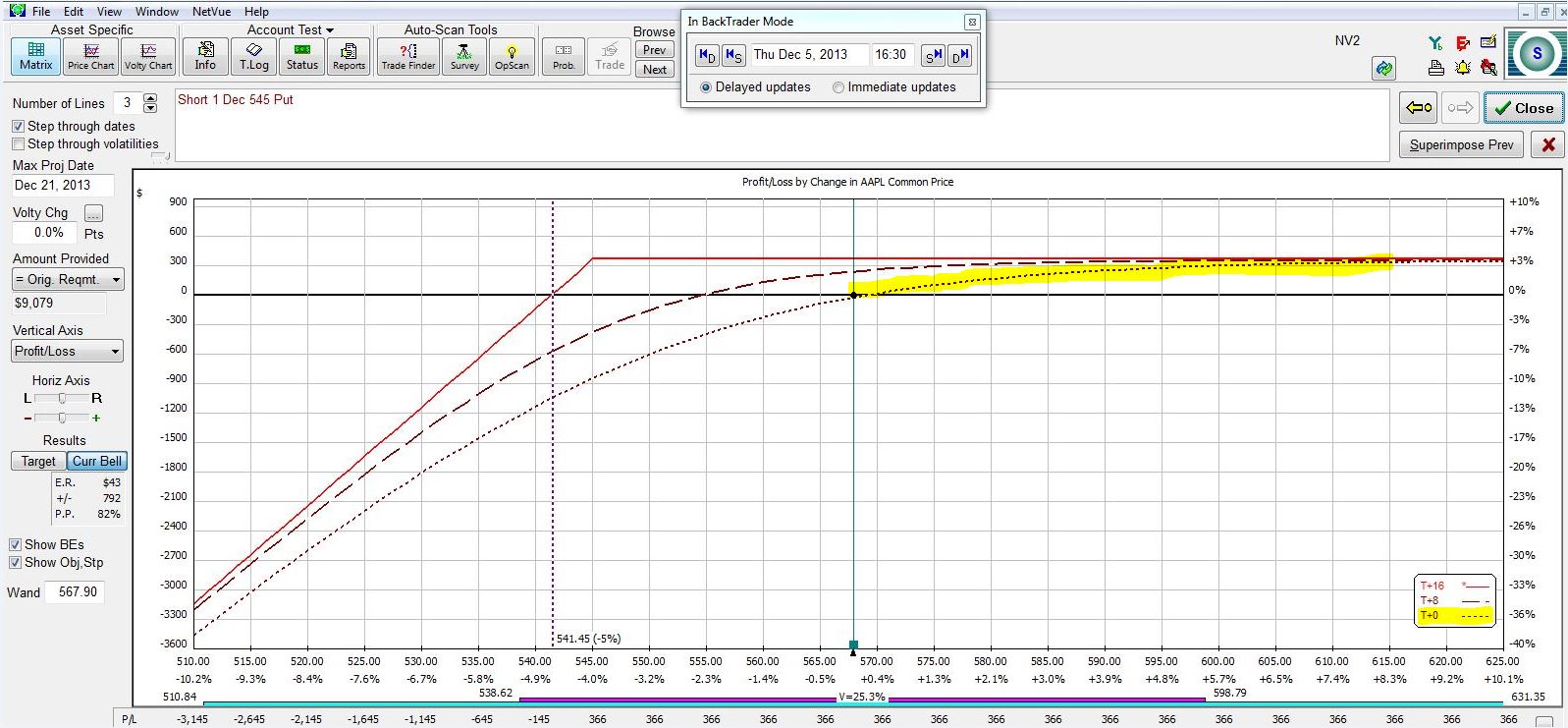

Make no mistake, though: the CC/CSP is still a bullish trade:

The T+0 curve (highlighted) represents today’s PnL. Note how the curve slopes upward to the right. If the stock goes up (down) today then this position makes (loses) money. While I make full profit on the position if AAPL has lost less than $22.90 in 16 days, if AAPL goes down today then I will feel some pain. Human nature suggests the faster AAPL stock declines, the more angst I will have over this position. Depending on my portfolio and trading plan, simply waiting until AAPL hits $545 may not be the best choice; if that happens today then I will lose at least twice what I could potentially make and probably a lot more because IV would substantially increase.

More considerations about the CC/CSP trade in my next post!

Comments (1)

[…] option and repeat the process every week or two to get the greatest annualized return and the least downside protection. If I think a market correction is around the corner then I might look to sell an option farther […]