Covered Calls and Cash Secured Puts (Part 12)

Posted by Mark on November 22, 2013 at 07:28 | Last modified: January 17, 2014 12:30I ended discussion in my last post with a suggestion that purchasing stock outright or trading the CC comes down to a matter of probabilities.

Purchasing the stock involves betting on a more improbable event to occur. Looking at the current option chain, suppose I purchase 100 shares of AAPL stock at $519.80 and sell a December (29) 530 call (20% implied volatility) for $7.40. The long stock will outperform the CC if AAPL rallies over $530 + $7.40 = $537.40 in 29 days. How likely is this to occur?

Let’s do some math based on the definition of implied volatility (IV):

1 standard deviation (SD) = Stock Price * IV * sqrt [ # days / 365]

1 SD = $519.80 * 0.20 * sqrt (29 / 365)

1 SD = $29.30

In this instance, AAPL must move $537.40 – $519.80 = $17.60 for the stock to outperform the CC.

# SD = $17.60 / $29.30 = 0.6 SD

How likely is this to occur?

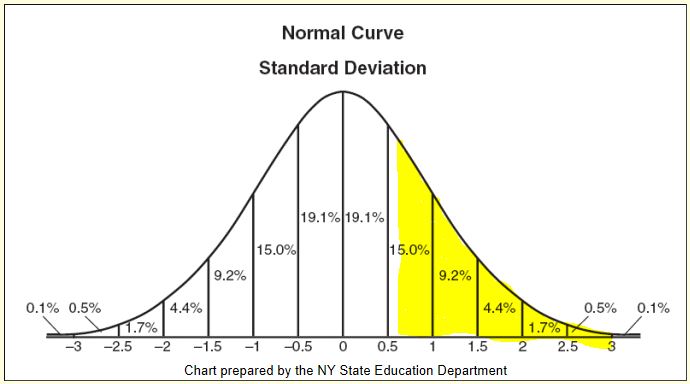

Looking at the graph I can see the chance of AAPL moving up at least 0.6 SD is under 30%.

If you are experienced with options then the rest of this post will be review.

To better understand this analysis, recall that it began with the option IV. IV describes how expensive an option is and how much the marketplace expects the stock to move over the next year (any time interval may be calculated by manipulating the equation). If traders believe an option is cheap then they will buy it and option price will increase. If traders believe an option is expensive then they will sell it and option price will decrease. People might think an option is cheap (expensive) if they expect the stock to move more (less) than IV suggests.

AAPL is among the most liquid of option markets and the more liquid the market, the more people (trading capital) are predicting the move. If you think you know more than the hundreds of millions of dollars (at least!) predicting the market, which include money managers, fund managers, professional advisors, analysts, big firms, etc., then just be careful.

I will continue this discussion in the next post.

Comments (1)

[…] last post spawned a couple other thoughts that are each worth at least a few hundred words to discuss. Today […]