Covered Calls and Cash Secured Puts (Part 11)

Posted by Mark on November 19, 2013 at 06:52 | Last modified: January 16, 2014 10:05In my last post, I showed graphical comparison of CCs ($BXM) and outright stock (S&P 500 index) over three different time intervals. One reason I believe more investors do not implement CCs is because they underperform in strongly bullish market environments.

To better understand this, I need look no further than the third graph from my last post:

Since mid-2012, S&P 500 (blue) is clearly outperforming $BXM (red). This happens in strong bull markets because shareholder profit goes parabolic (seemingly unlimited) along with the stock. In contrast, CC/CSP traders capture a maximal profit on every trade.

Human nature is to be dissatisfied when others are winning even if I am profiting, too. This is an emotional response.

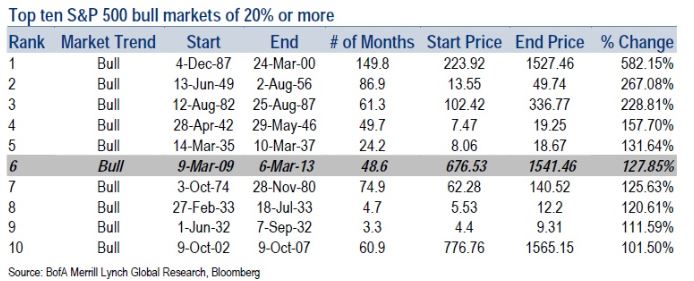

Emotions are sometimes illogical and I believe this is such an instance. What we are currently experiencing is a bull market of historic proportions. Barry Ritholtz lists the strongest bull markets since 1929 in this article:

Extrapolating from these data, the current bull market is up 164.27%, which ranks this as the fourth strongest bull market since 1929. This is a very unlikely occurrence! Is it logical to be dissatisfied when losing to a stroke of luck?

The nature of any game is that unlikely things sometimes happen. People do occasionally hit the jackpot on slot machines. Although few and far between, people do win the lottery. People do root for the underdog because the underdog does sometimes win. These are examples of good luck. Long stock investors taking credit for luck falling their way hints at the “fooled by randomness” argument, which is beyond the scope of today’s writing.

For now, I will summarize by saying one reason more investors don’t trade CC/CSPs is probably because of the potential to underperform when the masses seem to be celebrating. Those who do trade CC/CSPs in a raging bull market environment like this may be tempted to become “fully invested,” which can mean closing the short option and holding long stock outright.

I will continue this discussion in the next post.

Categories: Option Trading | Comments (1) | Permalink