Covered Calls and Cash Secured Puts (Part 3)

Posted by Mark on October 22, 2013 at 06:03 | Last modified: January 9, 2014 11:49In this blog series, I’m detailing different aspects of the CC/CSP trade in an attempt to develop some trading guidelines for future use. Today I want to explain why a CSP is less risky than owning stock outright.

Yes a CSP, or naked put, is less risky than owning stock. Why this is counterintuitive to many is something I will discuss in a future post. The first step to understanding it is to recall that a CSP and CC are synthetically equivalent.

Saying that a CC is less risky than owning stock outright may feel more comfortable because CCs have long been touted as a “conservative [option] strategy.”

Risk management is about limiting potential loss. With a CC, I buy the stock and sell a call. Selling the call puts money in my pocket. The CC is therefore cheaper than the stock. If the stock goes to zero then I lose less money with the CC than I do the stock because I already put money in my pocket. The CC is therefore less risky than the stock because I cannot lose as much money. The CSP is also less risky than the stock for the same reason.

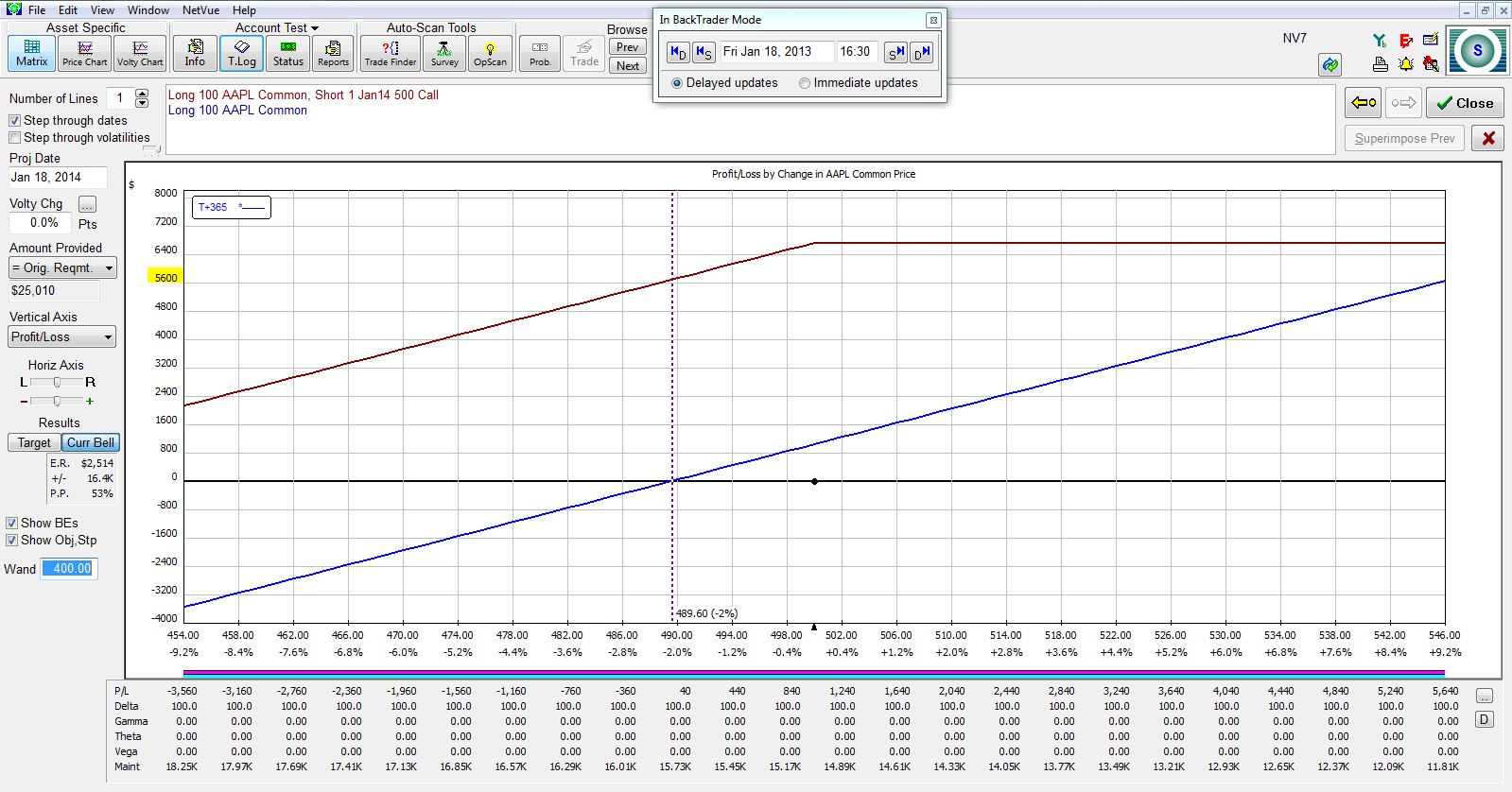

The following graph plots the PnL of AAPL stock (blue line) and CC position (purple line) 365 days after trade inception. The option expires on that day. Stock dividends ($1,040) are included:

The vertical, dotted line shows breakeven for the stock position if the stock price falls. At this zero profit level, the CC shows a profit of $5,600, which is the profit from selling the call at trade inception. The stock is more risky than the CC.

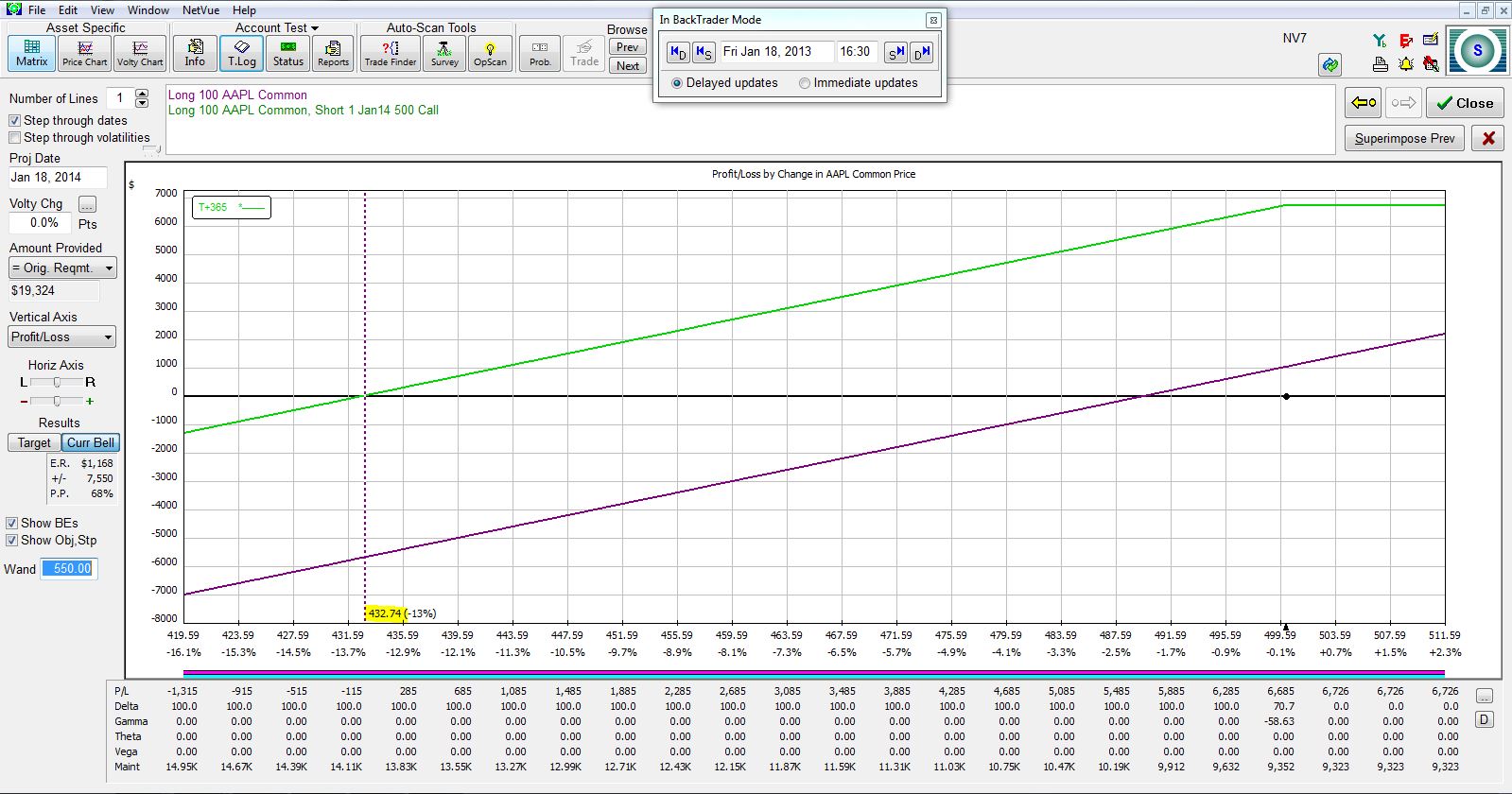

Viewed another way, for the CC (green line, below) to be at breakeven after one year, the stock would have to fall to 432.74, which is more than $55 lower than breakeven for the stock position (purple line, below) alone:

Either way you look at it, the stock is more risky than the CC.

Comments (6)

[…] the last post, I argued that CCs and CSPs are less risky than owning stock outright. People are often surprised […]

[…] part 3 of this blog series, I discussed why CC and CSPs are less risky than outright stock. Why don’t more investors […]

[…] last post deserve membership in my optionScam.com category? Probably not because as discussed in part 3, CC/CSPs are less risky than outright stock ownership. A great many people are willing to own […]

[…] from being less risky than stock, the $BXM is another reason I am biased to believe in CCs and […]

[…] Earlier in this blog series I posted a risk graph showing why CCs and CSPs are less risky than stock. In the last post, I reviewed backtesting results showing index CC returns ($BXM) to be roughly equivalent to the index itself with only 67% of the volatility. This affirms my former illustration and can mean better returns for traders. […]

[…] belief in trading naked puts (NP) goes back to some early posts I wrote on the topic. Occasionally, however, I am blinded by an illusion that suggests the […]