Weekly Iron Butterfly Backtest (Part 27)

Posted by Mark on August 19, 2013 at 07:13 | Last modified: December 5, 2013 12:36In this blog series, I’m backtesting the weekly option trade described here.

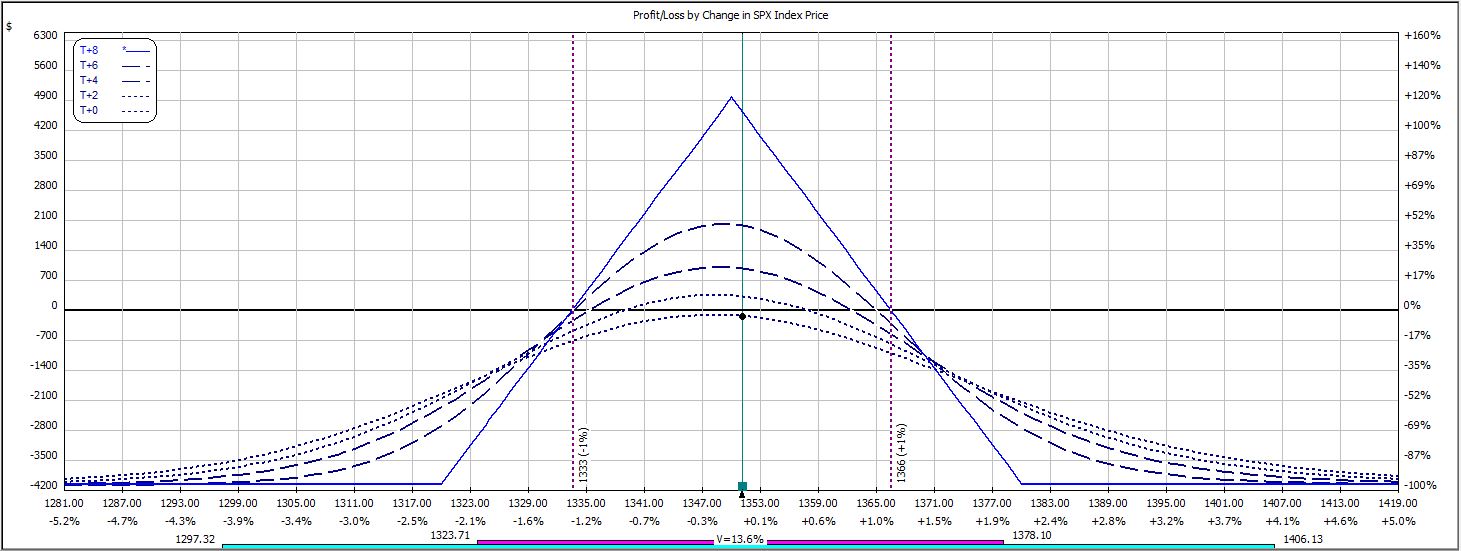

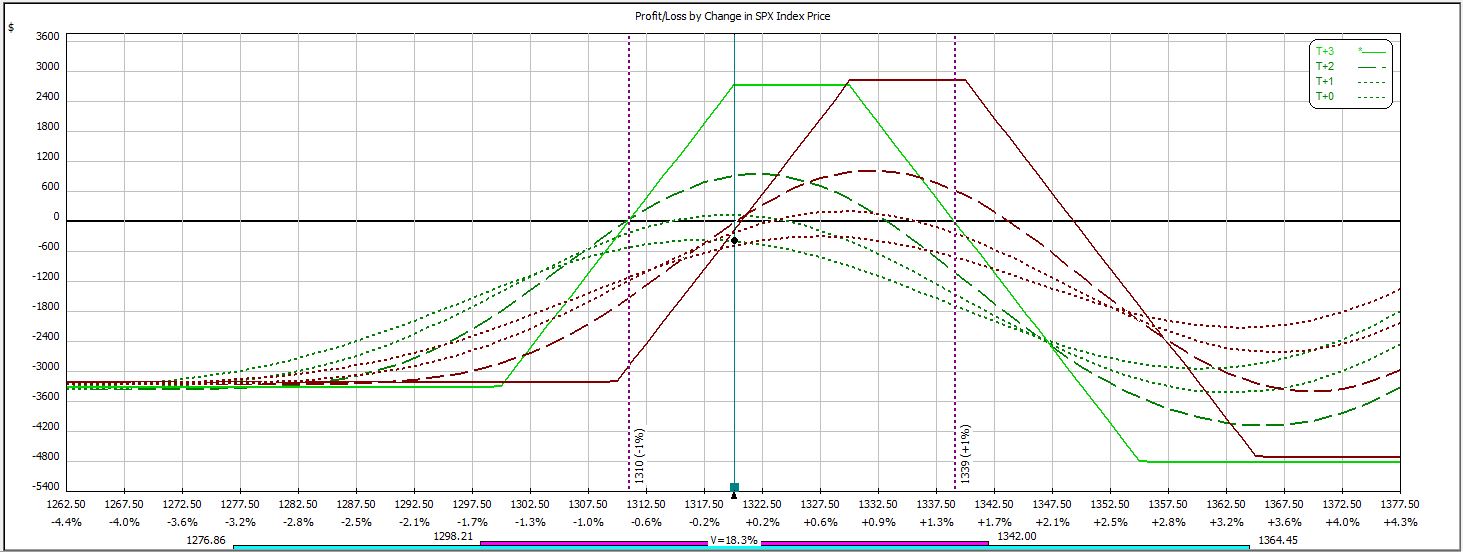

Week 26′s trade begins with this:

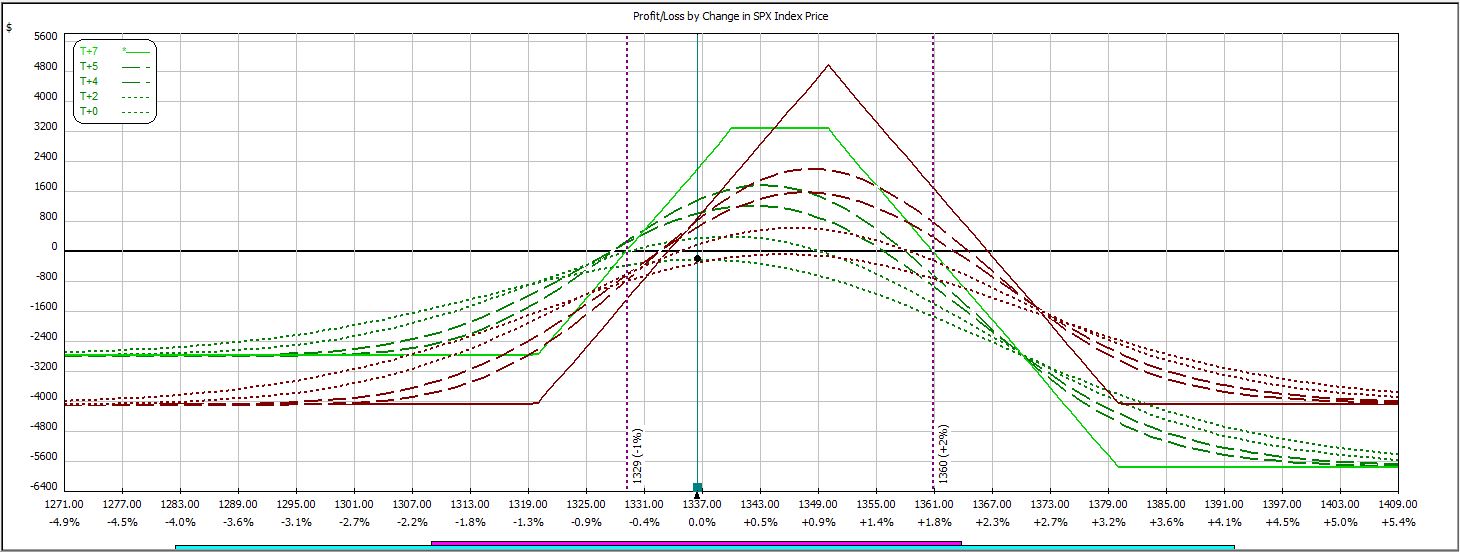

After threatening the upside, the market reversed and hit a downside adjustment point:

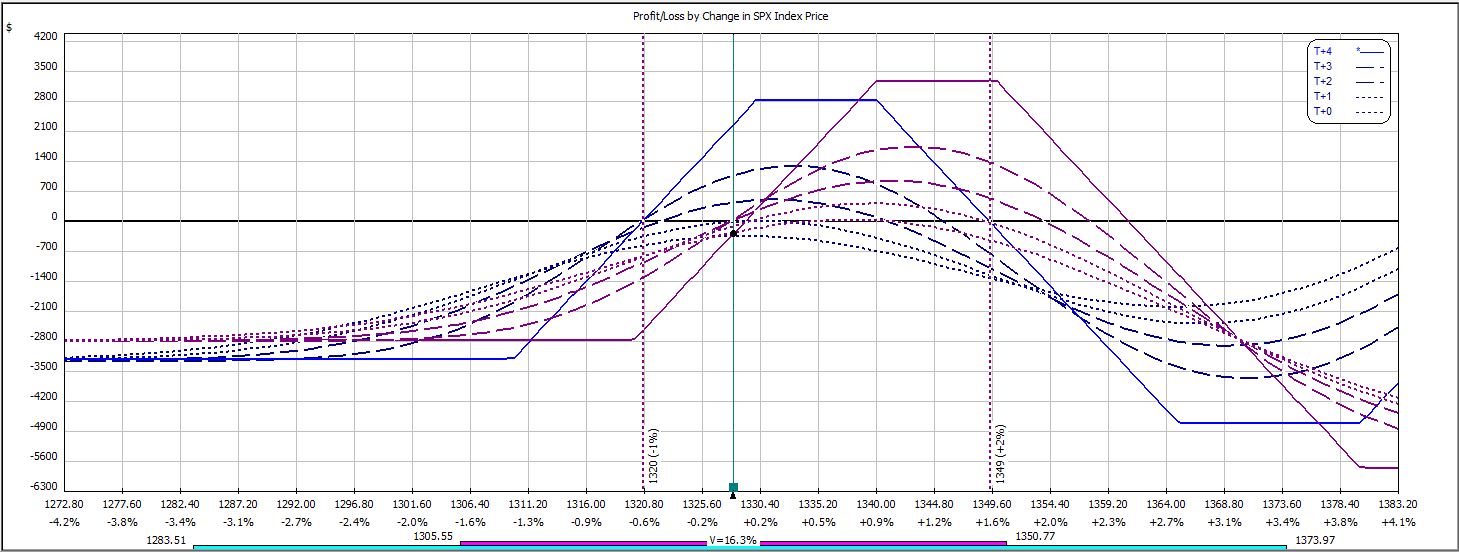

After the weekend, the market continued to move lower and hit a second adjustment point:

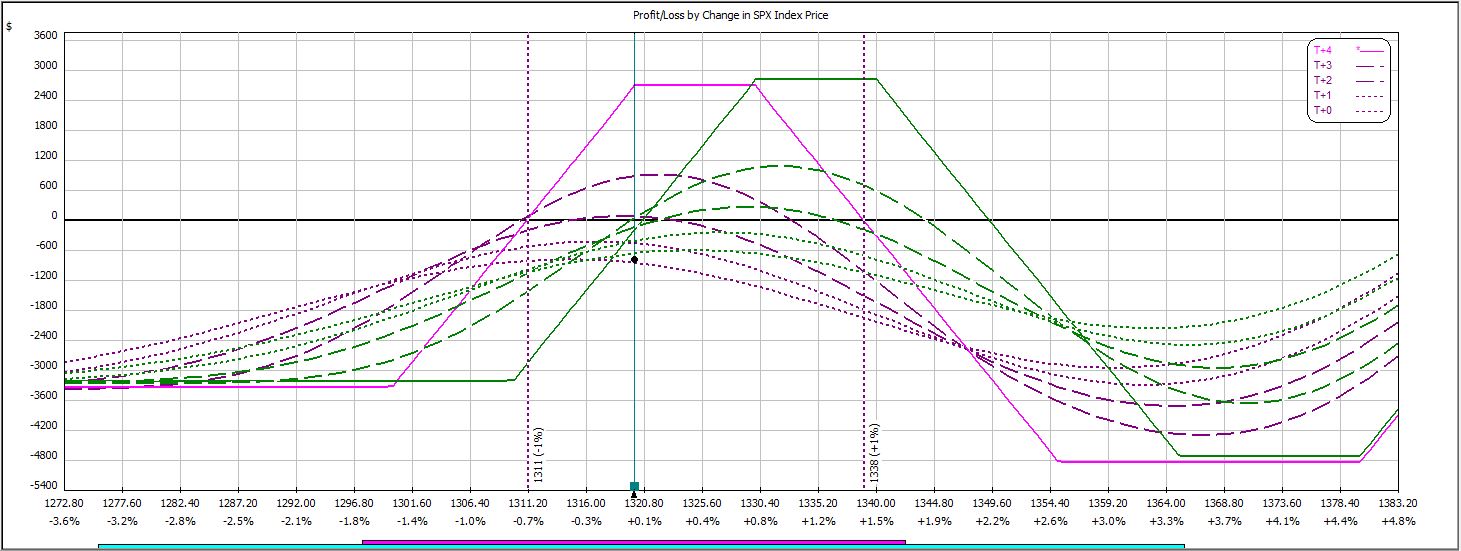

The market continued moving lower that day and hit a third adjustment point:

Due to transaction costs, this adjustment would have taken the trade from a loss of $777 to $921, which is max loss. I therefore did not make the adjustment.

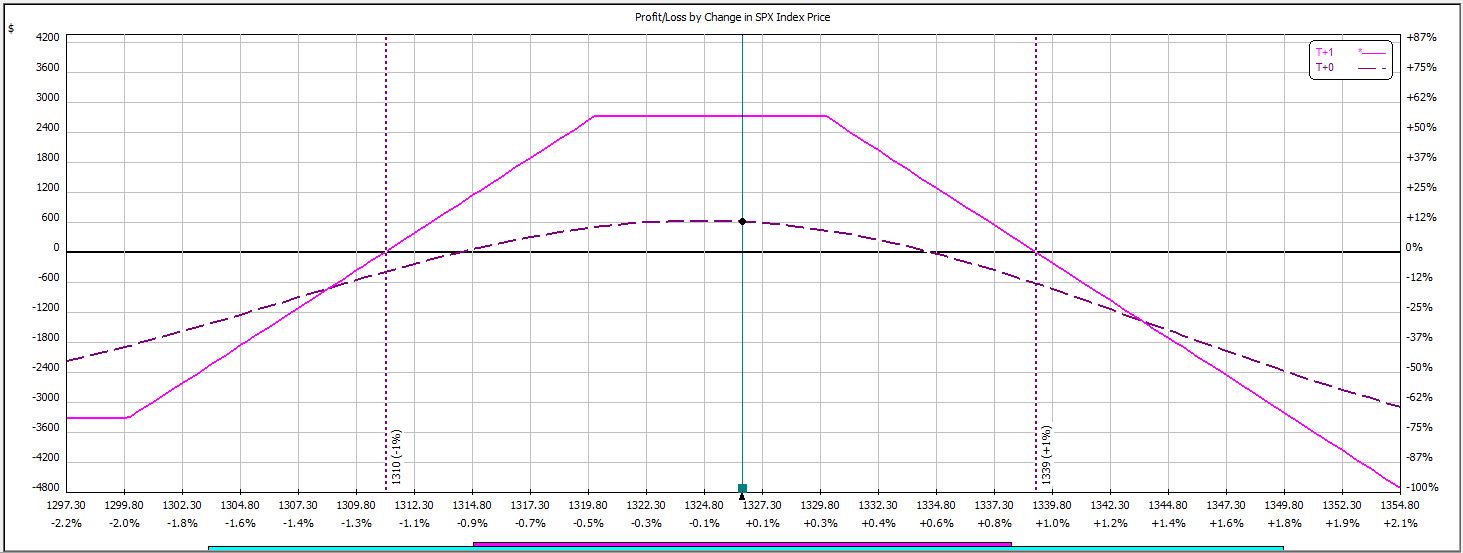

The trade survived into the next day where the market continued to hang out below the third adjustment point. Having collected an additional day of time decay now, I could afford to make the adjustment without hitting max loss:

The market traded in a range into expiration Thursday when the profit target was realized:

P/L on Day 1 ranged from +$90 to -$498.

P/L on Day 2 ranged from +$27 to -$287 on an adjusted margin requirement of $5,769.

P/L on Day 5 (nothing happened over the weekend) ranged from -$435 to -$777 on an adjusted margin requirement of $4,719.

P/L on Day 6 ranged from -$291 to -$633 on an adjusted margin requirement of $4,812.

P/L on Day 7 ranged from +$345 to -$264.

The trade was closed on Day 8 for a profit of $588, which is a return of 10.2% on max margin.

This trade has now won in 14 out of 26 weeks.

Categories: Backtesting | Comments (0) | Permalink