Weekly Iron Butterfly Backtest (Part 26)

Posted by Mark on August 16, 2013 at 07:51 | Last modified: December 5, 2013 12:33In this blog series, I’m backtesting the weekly option trade described here.

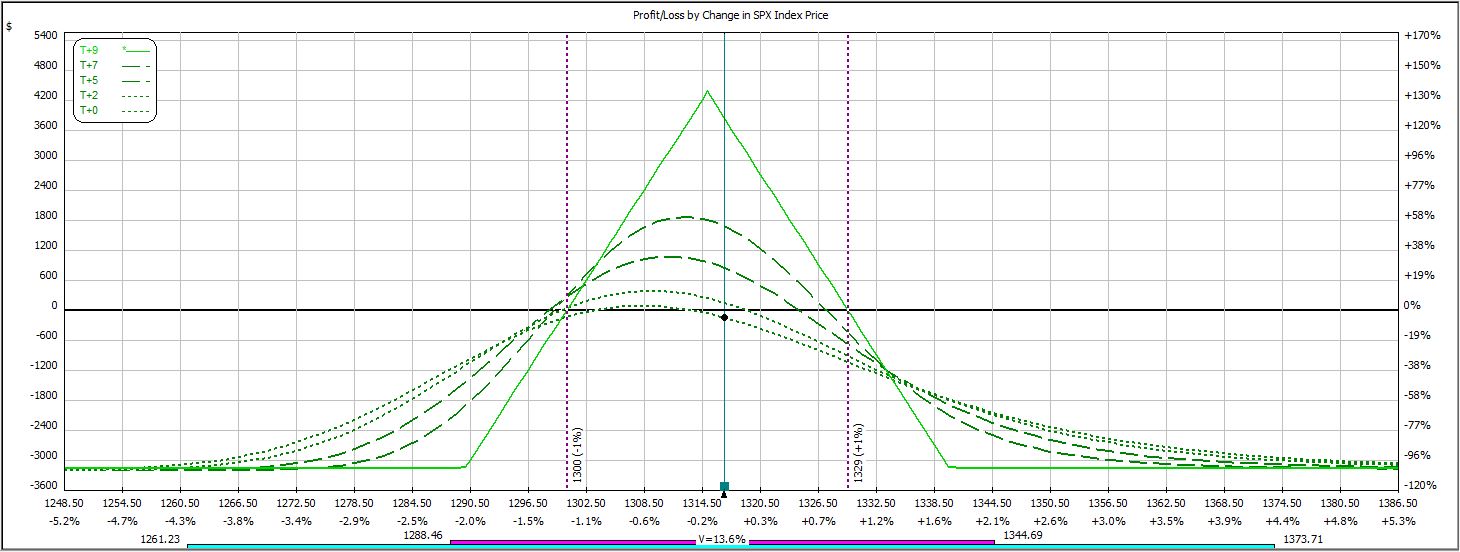

Week 25′s trade begins with this:

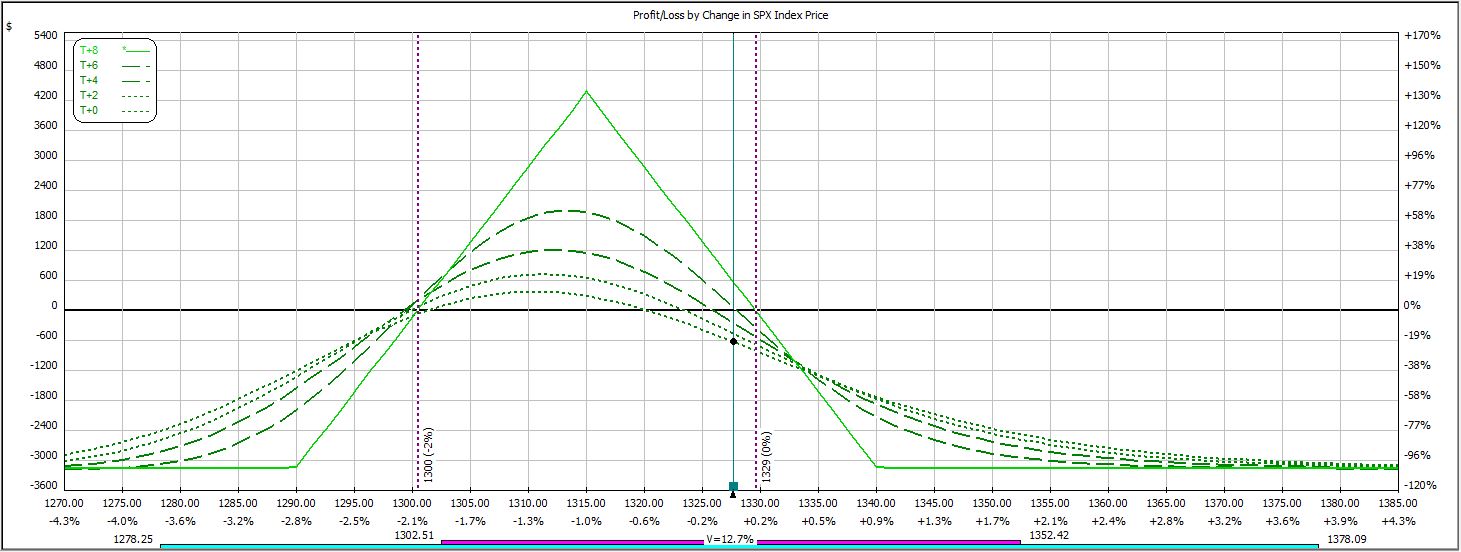

The market rallied into Friday and hit an adjustment point:

Unfortunately, the trade was already down $621. Slippage on the adjustment alone would push this trade beyond the max loss of $631. Exiting the trade prematurely would insert an additional parameter into this trading system (i.e. how many dollars under max loss does the P/L need to be to allow for adjustment). Since more parameters requires more detailed backtesting to avoid curve-fitting, I opted to hold on.

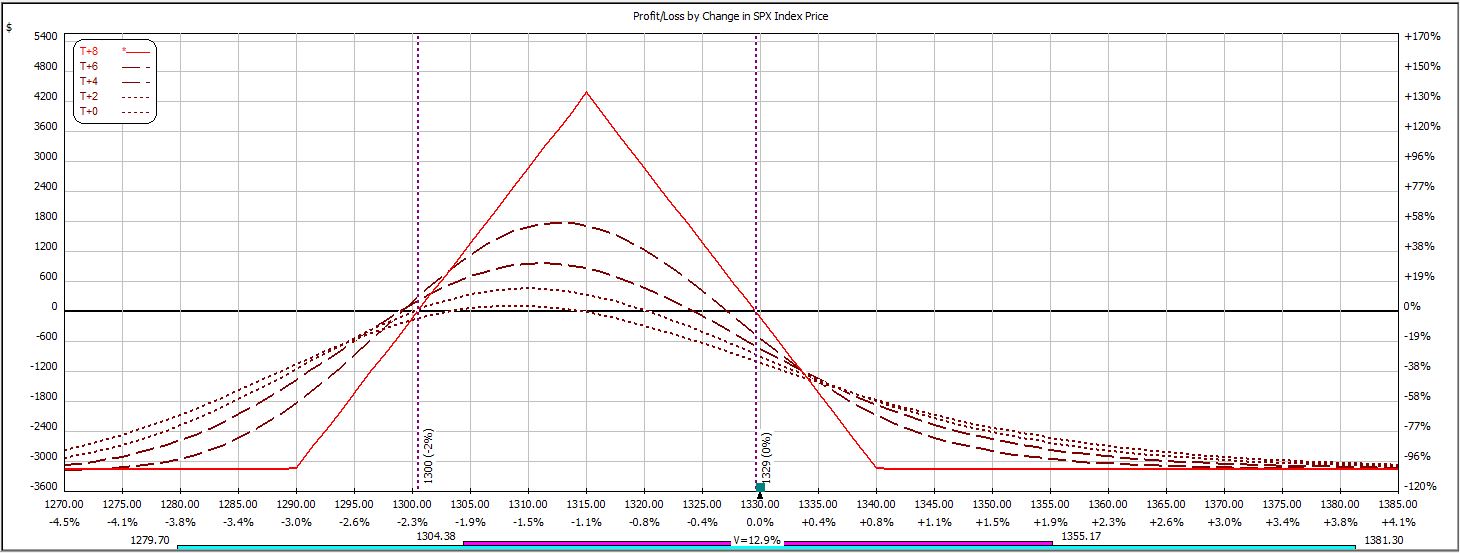

Max loss was realized soon after:

This trade lost $1,035, which is 32.8% on $3,159 margin. The market rallied 13 points–about 1%–in one day to knock this trade out.

The trade is now 13-12 in 25 weeks.

Categories: Backtesting | Comments (0) | Permalink