Weekly Iron Butterfly Backtest (Part 25)

Posted by Mark on August 14, 2013 at 05:54 | Last modified: September 10, 2013 10:49In this blog series, I’m backtesting the weekly option trade described here.

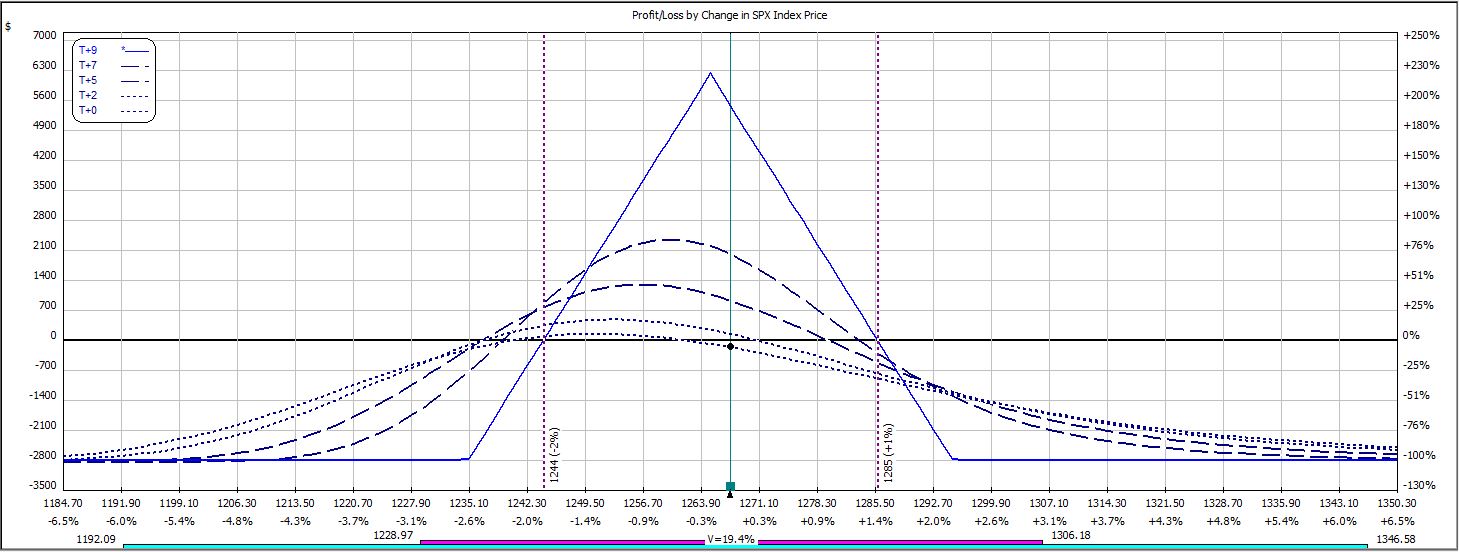

Week 24′s trade begins with this:

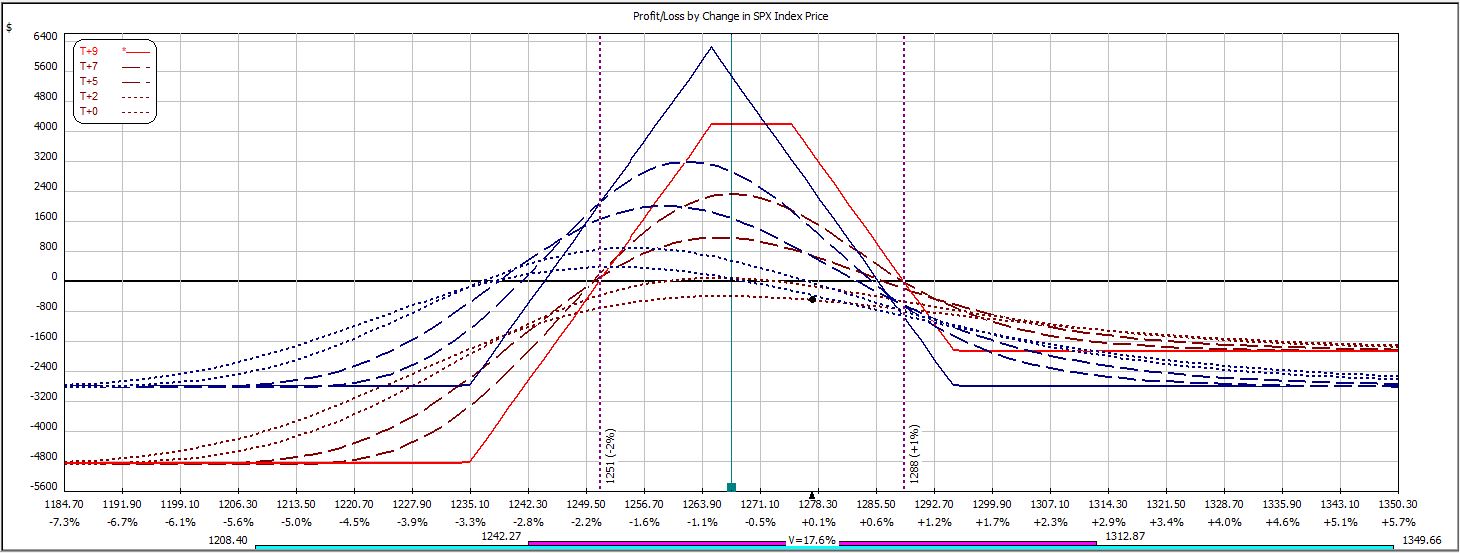

The market rallied in the afternoon to an adjustment point:

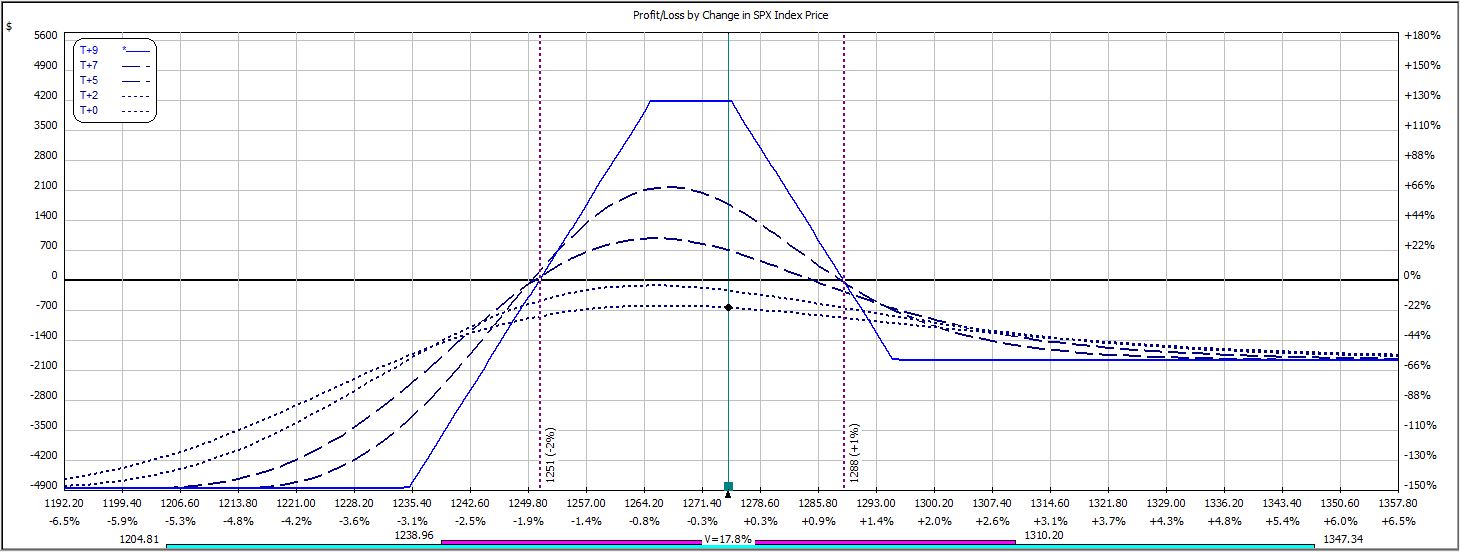

Soon after, the trade hit max loss of 12.9% on max margin of $4,857:

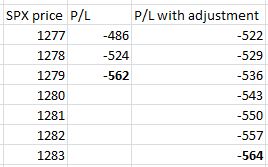

The trade was down $486 before the adjustment and $522 afterward. While slippage is a reality of trading, perhaps I should not have adjusted with max loss being $560? The adjustment did cut net position delta from -38 to -7. Taking into account delta only (gamma was slightly higher in the non-adjustment case), the following table shows projected P/L with and without adjustment:

Basically this trade is damned if I do and damned if I don’t. Adjustment gave the trade farther to run before hitting max loss, which was hit anyway.

The trade is now 13-11 in 24 weeks.