Weekly Iron Butterfly Backtest (Part 21)

Posted by Mark on August 5, 2013 at 06:40 | Last modified: August 25, 2013 12:45In this blog series, I’m backtesting the weekly option trade described here.

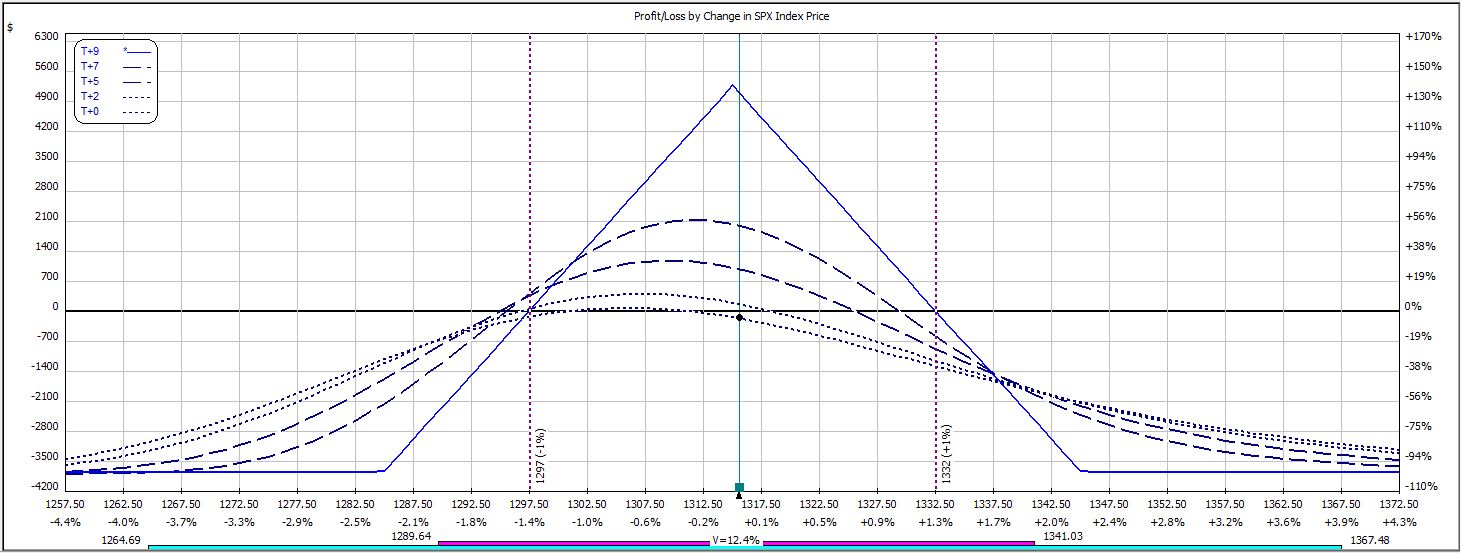

Week 20′s trade begins with this:

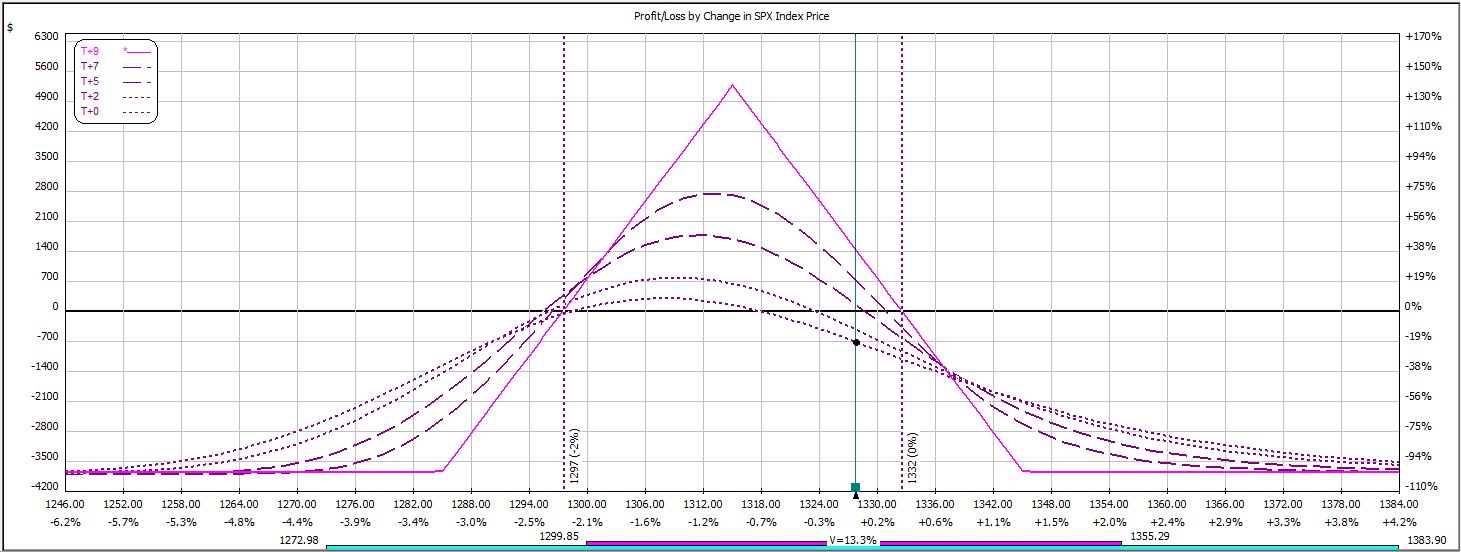

The market rallied on Day 1 to an adjustment point. The adjustment could not be made, however, because slippage alone would put the trade at max loss:

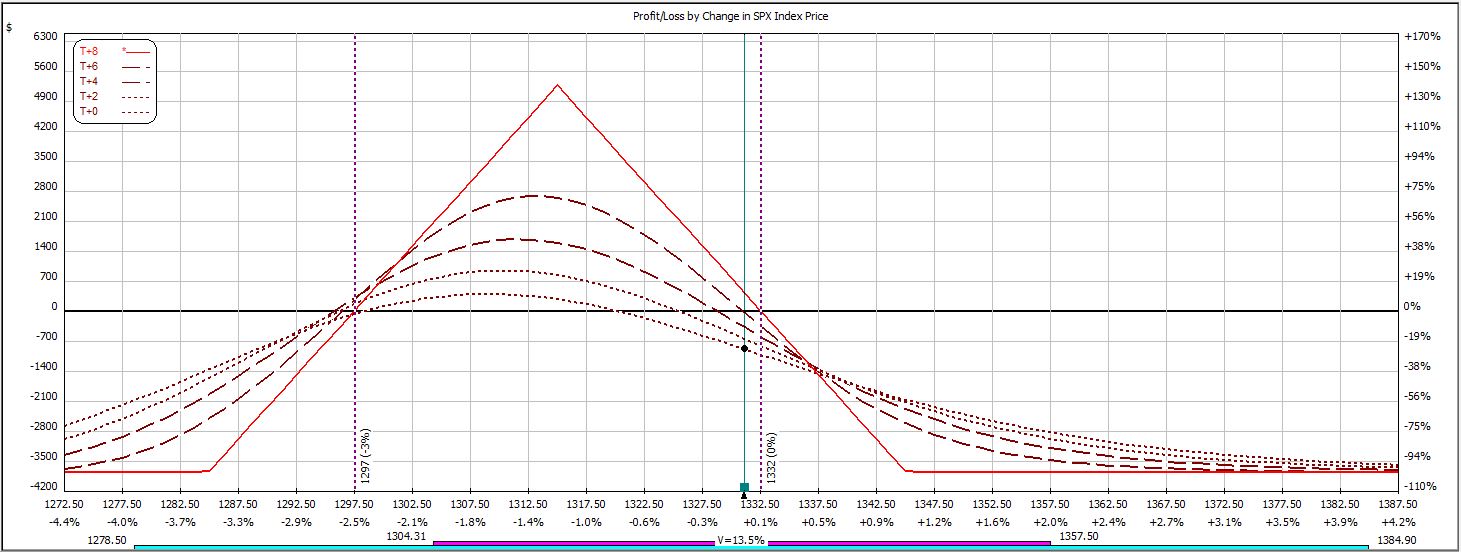

Max loss was hit early on Day 2:

P/L ranged from -$714 to -$144 on Day 1.

The trade was closed on Day 2 for a loss of $867 on $3,759 margin, which is -23.1%.

In 20 weeks, the trade has now won 10 times.

Categories: Backtesting | Comments (0) | Permalink