Weekly Iron Butterfly Backtest (Part 14)

Posted by Mark on July 19, 2013 at 07:35 | Last modified: August 7, 2013 14:26In this blog series, I’m backtesting the weekly option trade described here.

Week 13′s trade begins like this:

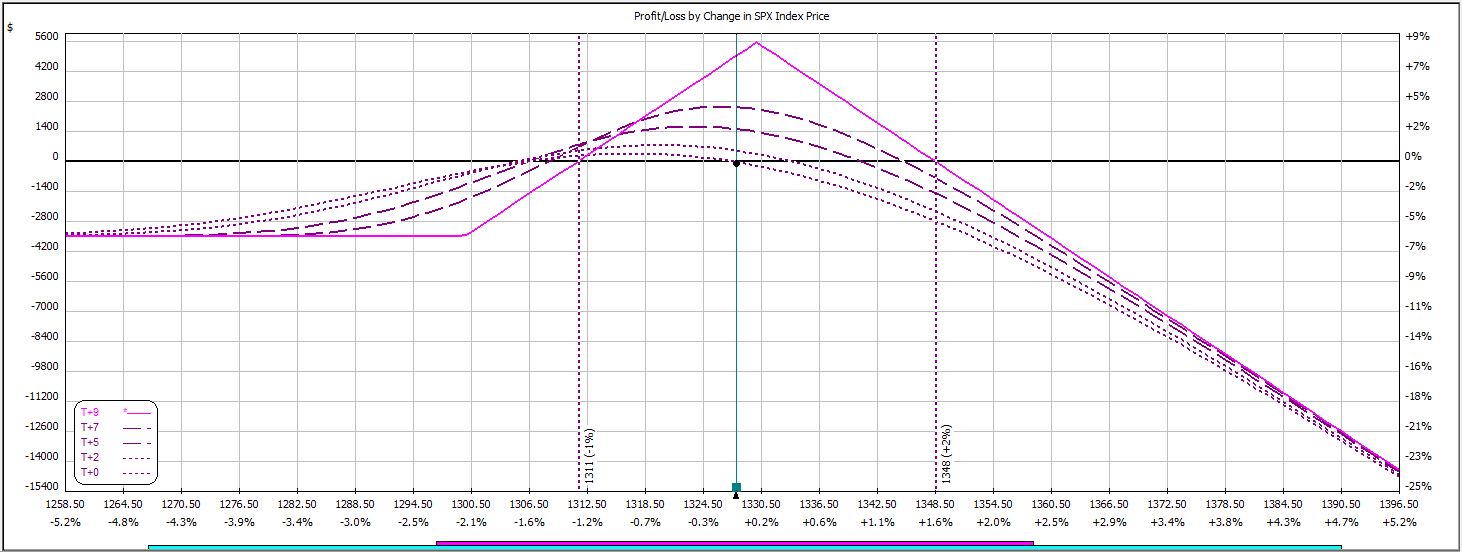

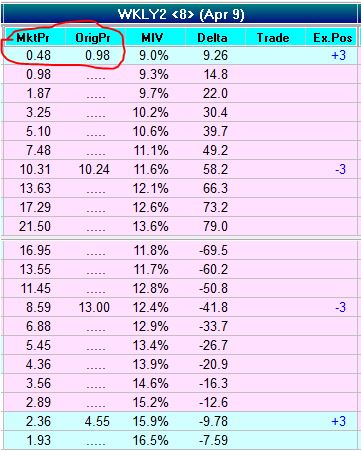

No long call data was available in the software for Day 1 of the trade. As a result, I entered three out of four legs and added the long call on Day 2. To ensure I was not paying too little for an option with eight days to expiration instead of nine, I purchased the long call for what it would cost to buy one strike closer to the money:

Here is the full trade after adding the long call:

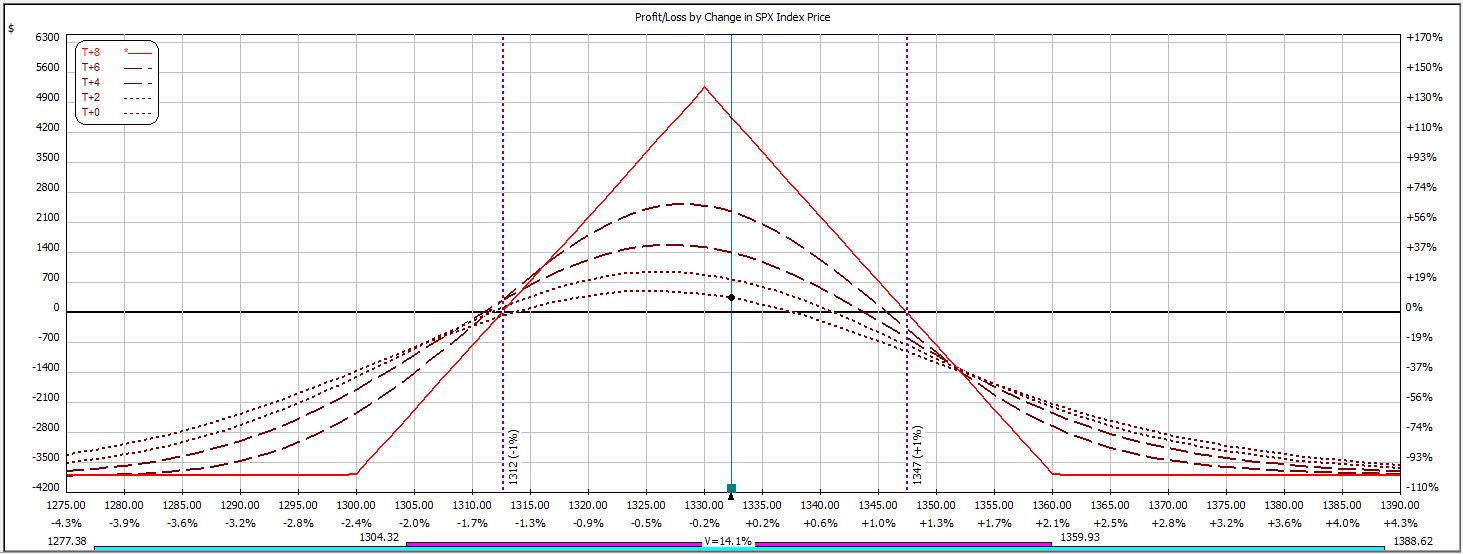

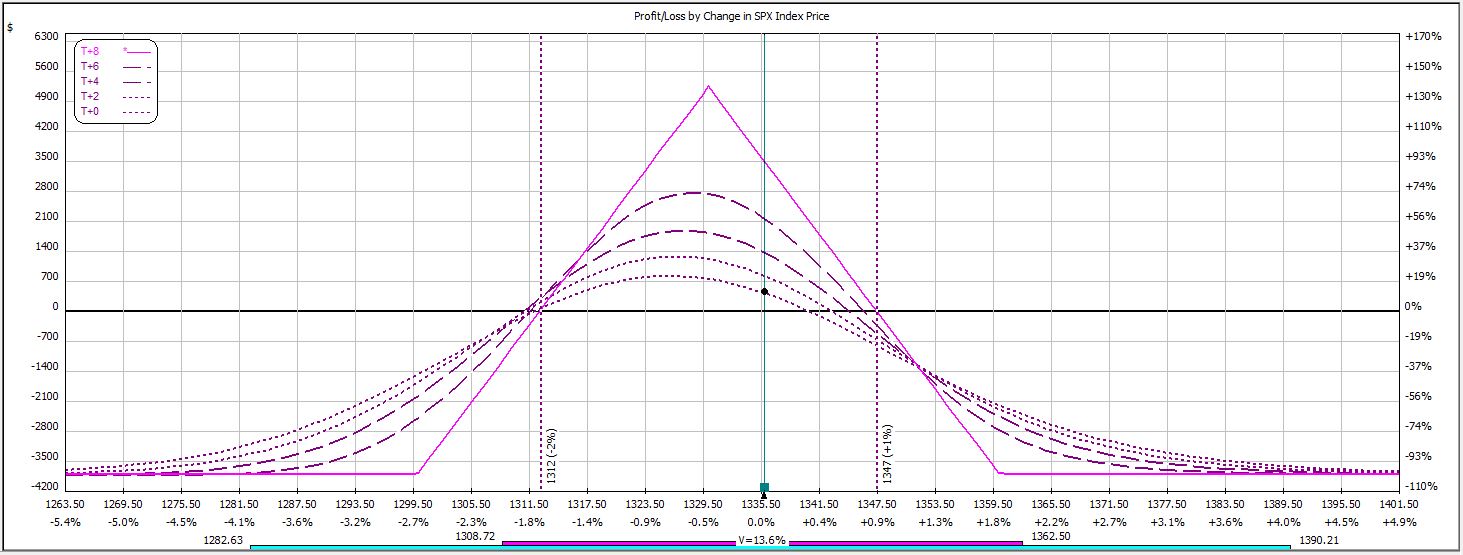

This trade closed at the profit target later on Day 2:

P/L on Day 1 ranged from -$114 to +288, but this is not entirely accurate since the long call was missing.

P/L on Day 2 ranged from +$132 to +$462 on $3,795 margin requirement: a return of +12.2%.

This trade has been profitable in eight out of 13 weeks.

Categories: Backtesting | Comments (0) | Permalink