Weekly Iron Butterfly Backtest (Part 11)

Posted by Mark on July 12, 2013 at 06:10 | Last modified: August 5, 2013 11:30In this blog series, I’m backtesting the weekly option trade described here.

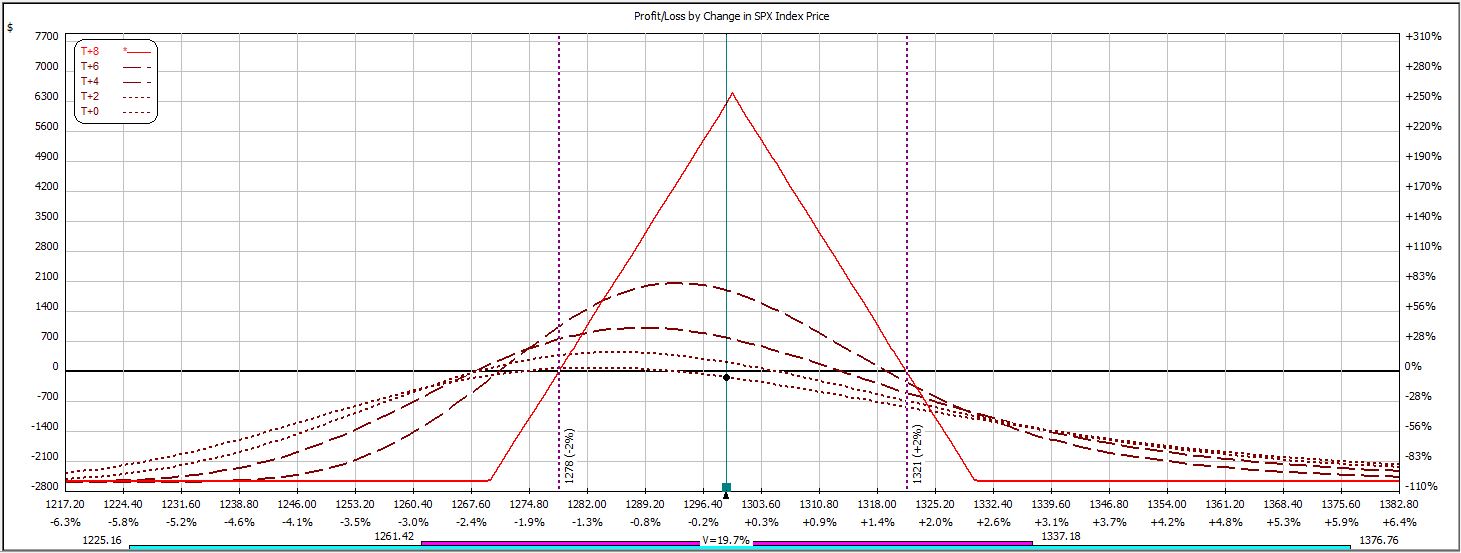

Week 10′s trade begins like this:

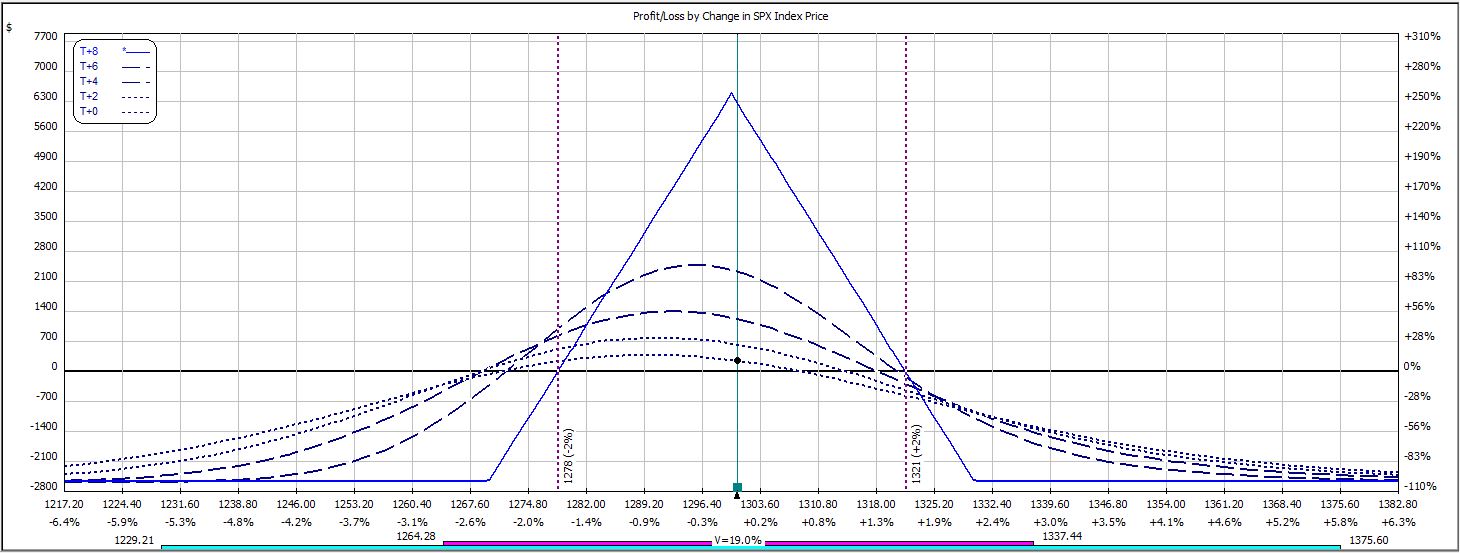

This trade closed in less than two hours at a profit target:

I’ve heard a number of traders talk about placing these weekly iron butterflies on Thursday and getting out before the weekend. This is the first time I have actually seen it in backtesting.

What happened?

The market was down 1.5% early on Thursday and IV had spiked 2.5%. The market traded sideways for the next 90 minutes and IV decreased 0.7%. This was enough to reach the profit target.

The margin requirement on this trade was only $2,556. The IV spike led to decreased cost of the butterfly spread. While getting out profitably in hours seems like a great thing, the downside is the lowest profit target seen thus far.

The trade has now won six times and lost four. Since the average loss outpaces the average win by a factor more than two, I am not ready to trade this with real money. We’ll see in time if the three consecutive losers were more the rule or the exception.