Trader Meetups (Part 13)

Posted by Mark on April 15, 2013 at 06:07 | Last modified: July 25, 2013 12:17I have spent the last three posts discussing JD’s meetup presentation from February 28.

As mentioned previously, JD spoke very little about trades gone bad or about how to manage them. I discussed his brief mention of keeping tight stops, which is controversial. He spent one minute explaining that you don’t want to risk more than 5-10% of your account on any one trade. This is also highly controversial. To lose so much with one trade would put me at a very high risk of ruin. I challenge you to find an experienced trader anywhere who would recommend 5-10% position sizing for beginners (or experts!).

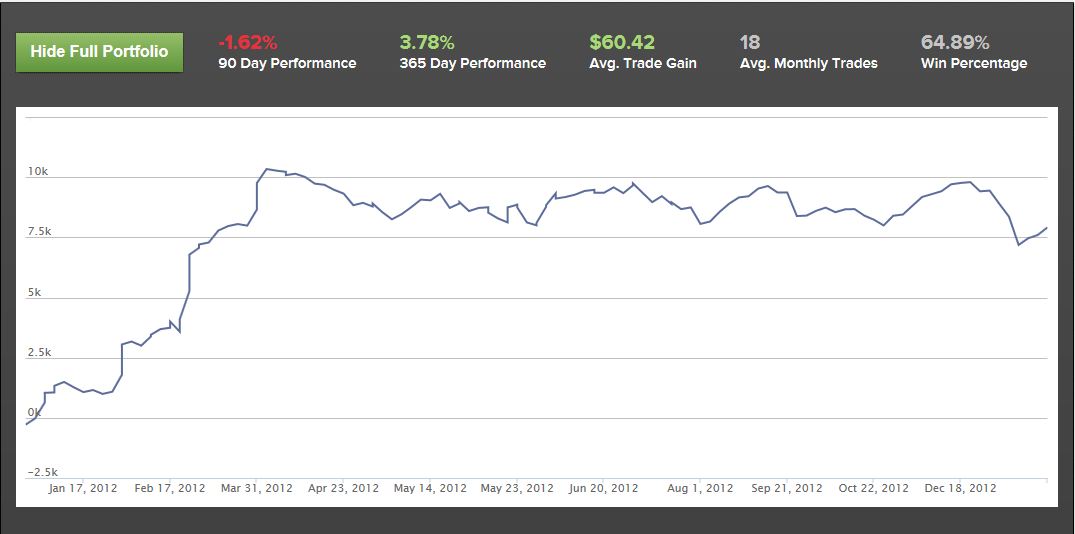

I keep telling myself that JD is supposedly a full-time option trader with over 10 years of experience but his performance as shown on the web site is no more encouraging:

Kudos to JD for not losing money with this service. Aside from the initial two weeks that lost, all money made was in the first four months after inception, though. He lost money from March 20, 2012, through February 27, 2013: 344 days of losing during which time the S&P 500 was up over 10.5%. At 18 trades per month, I would have lost money over the course of 203 trades. As performance numbers don’t usually include transaction costs, I probably would have lost more than the 0.6% loss shown in the graph.

For this service he is charging $79/month.

Why did he imply trading to be like taking candy from a baby if he can’t do it successfully himself?

optionScam.com, anyone?

Categories: optionScam.com | Comments (2) | Permalink