Trader Meetups (Part 16)

Posted by Mark on April 26, 2013 at 02:03 | Last modified: July 25, 2013 12:21I have spent the better part of two months discussing topics related to trader meetups. The time has come to tie up some loose ends.

I meant no insult to beginners in part 8 where I described my concept of the real trading group. Recall that the real trading group has a shared goal between all members and the group itself: use of advanced understanding to become better traders. No conflict of interest means no optionScam.com. As with everything else, all traders [including me!] start[ed] as beginners. The label implies neither good nor bad: just matter of fact. Beginners have no advanced understanding, though. In an advanced group, beginners would be a source of imbalance and distraction. Focus cannot be maintained when having to stop frequently and explain basic tenets of trading, which is what beginners would need to make sense out of real trading group’s work.

By definition, the beginner has little to offer the advanced trader. When beginning and advanced traders interact, the advanced traders are either getting paid for their services or are looking to “give back” in the spirit of charity. No other arrangement makes sense so beware if you see a situation involving both levels of expertise (e.g. meetup groups).

To get ahead in the markets requires a tireless work ethic to complete the work described in part 4 and part 5. Lazy attitudes and freeloaders will not prevail. Malcolm Gladwell’s “10,000-hour rule” may be a good approximation to quantify how much effort is needed. Trader meetups led by commercial organizers, unfortunately, are not designed to help with any of this. Such meetups often begin with food, drink, discussion of lavish vacations or living in tropical destinations, and other themes designed to immediately activate the brain’s hedonistic center through release of endorphins.

This is more about psychological manipulation than honest effort to improve trader efficacy.

Some call it sales tactics.

I call it optionScam.com.

Categories: optionScam.com | Comments (1) | PermalinkTrader Meetups (Part 15)

Posted by Mark on April 23, 2013 at 09:44 | Last modified: July 25, 2013 12:20In the last post, I summarized flaws of the February 28 meetup. I concluded by calling it everything I dislike about commercial (something to sell) organizers. This is optionScam.com because of conflicting interests, which likens it in my eyes to the financial media.

My interest is to be successful whereas the organizer’s interest is to get my money. The organizer really does not care whether I succeed even though she purports to have my best interest at heart. Sure, I may provide positive testimonials or referrals if the product helps me succeed. If I don’t succeed then all the organizer really cares about is that I never become so disenchanted that I tell everybody how horrible the product is. If I purchase the product, am unsuccessful, and decide trading is not for me as I walk quietly into the night, the organizer will be content. This is optionScam.com.

In a similar way, financial media like CNBC is also optionScam.com because of conflicting interests. CNBC has many talking heads and investment/trading “gurus” who offer recommendations and trading advice. Most traders I’ve heard or communicated with doubt anybody can consistently profit from CNBC. Personally, I regard the media as blatant distraction that should be banned from my trading day because it can generate emotional reaction and overtrading. CNBC’s interest is to make money. The more entertaining its programming, the better its ratings and the more advertising contracts they sign. In essence, CNBC’s interest is to profit off my viewership whereas my interest is to succeed as a trader. As with the meetup organizer, if I watch CNBC and lose big money trading, the network will be content to see me walk quietly into the night as long as I don’t blame the network for my failure and tell everyone how bad it is. This would be bad for its business.

In the next post, I will work to tie up some loose ends.

Categories: optionScam.com | Comments (0) | PermalinkTrader Meetups (Part 14)

Posted by Mark on April 18, 2013 at 07:03 | Last modified: July 25, 2013 12:19In the past few posts, I have made several observations about JD’s meetup presentation on February 28 that make me think of him more as a salesman for a mediocre service than as a successful, full-time option trader.

From an educational standpoint, I would rate the presentation an F because of his persistently smug and overconfident tone. Many in the crowd identified themselves as “beginners” when asked. Beginners get sold relatively easily and don’t know what due diligence to perform. I wonder how many attendees thought to check the web site to see how well JD actually does with his trades? I thought about asking why his stated performance was so poor, which contradicted his cool and confident underlying tone, but I could not remember the exact numbers and thought it might be rude and land me on the street outside.

Besides, I smelled the pizza and hoped to get my fair share.

To recap the flaws:

–Extensive time spent illustrating a complex trading system with only one chart

–No backtesting of system performed (“it just makes money”)

–Arrogant representation of option trading (like an ATM machine)

–Hardly any discussion of risk management implies trades rarely lose or lose very little (false!)

–Well-known option myth presented as fact (twice)

–Earnings plays described as easy and consistently profitable (at least 15 other traders disagree)

–Pizza, pop, and beer made for an oasis of refreshment

Taken together, this presentation seemed to be more about sales and marketing for a $79/month service than anything else. This is optionScam.com and pretty much everything I don’t like about meetup groups being organized by people with commercial interests.

Categories: optionScam.com | Comments (0) | PermalinkTrader Meetups (Part 13)

Posted by Mark on April 15, 2013 at 06:07 | Last modified: July 25, 2013 12:17I have spent the last three posts discussing JD’s meetup presentation from February 28.

As mentioned previously, JD spoke very little about trades gone bad or about how to manage them. I discussed his brief mention of keeping tight stops, which is controversial. He spent one minute explaining that you don’t want to risk more than 5-10% of your account on any one trade. This is also highly controversial. To lose so much with one trade would put me at a very high risk of ruin. I challenge you to find an experienced trader anywhere who would recommend 5-10% position sizing for beginners (or experts!).

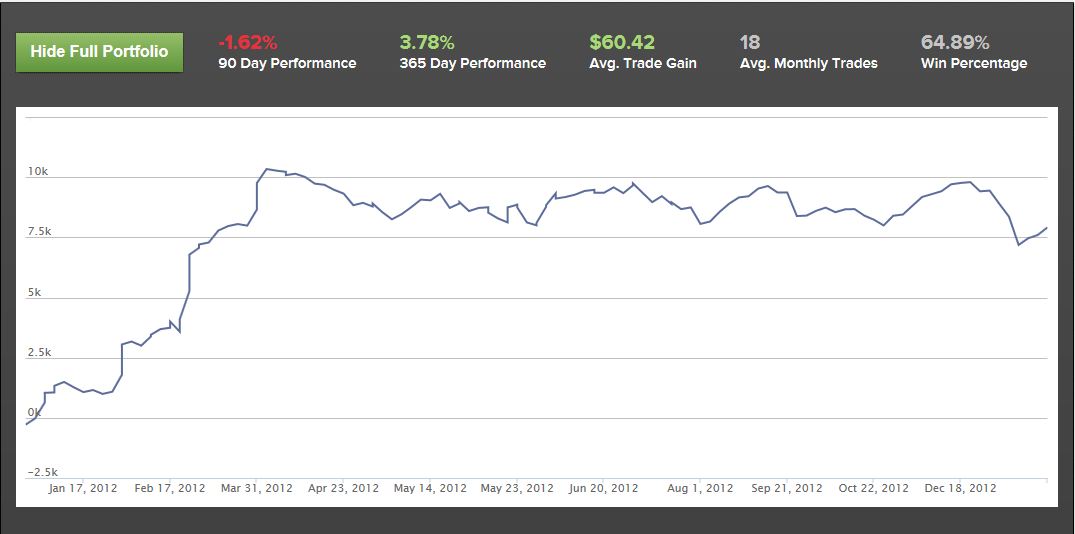

I keep telling myself that JD is supposedly a full-time option trader with over 10 years of experience but his performance as shown on the web site is no more encouraging:

Kudos to JD for not losing money with this service. Aside from the initial two weeks that lost, all money made was in the first four months after inception, though. He lost money from March 20, 2012, through February 27, 2013: 344 days of losing during which time the S&P 500 was up over 10.5%. At 18 trades per month, I would have lost money over the course of 203 trades. As performance numbers don’t usually include transaction costs, I probably would have lost more than the 0.6% loss shown in the graph.

For this service he is charging $79/month.

Why did he imply trading to be like taking candy from a baby if he can’t do it successfully himself?

optionScam.com, anyone?

Categories: optionScam.com | Comments (2) | PermalinkTrader Meetups (Part 12)

Posted by Mark on April 11, 2013 at 06:03 | Last modified: July 25, 2013 12:15I have spent the last two posts discussing a new meetup I attended on February 28.

Consistent with the “trading is like an ATM machine” theme, the meetup presenter JD talked quite a bit about earnings announcements as another “slam dunk” approach to option trading. He talked about the volatility crush that occurs after earnings and why this is a windfall for anyone applying short option strategies. JD represented no significant effort required to place these trades: even if the market moves against, you will likely profit.

I have listened to discussion by many about trading earnings announcements either directionally (verticals) or nondirectionally (time spreads before or credit spreads through the event) and only once have I heard a trader claim to have consistent success. She attributed her success to extensive time spent studying option chains to see if she could place trades for a requisite profit potential based on past earnings moves.

JD seems to just slap the trades on haphazardly and collect profits. If trading were easy then wouldn’t all market makers (and associated firms) be out of business already?

At best, earnings plays should be treated as speculative: trades to be done in extremely small contract size. Regard them as lottery tickets. They will not pay your mortgage or recurrent living expenses. This is all about risk management and JD discussed none of it.

With regard to risk management, on two brief occasions JD did mention keeping a tight stop near the entry level. He never went into depth about what a portfolio can actually lose by implementing this stop-loss over many trades. The educated trader will tell you that tight stops, which imply low risk, aren’t necessarily a good thing because more often than not due to the market’s random volatility, they will get hit for small losses. One may suffer death by a thousand cuts just as one may suffer death by one huge accident.

I will discuss this meetup further in the next post.

Categories: optionScam.com | Comments (1) | PermalinkTrader Meetups (Part 11)

Posted by Mark on April 10, 2013 at 05:48 | Last modified: July 25, 2013 12:14I concluded my last post with an open question. Does it seem suspicious that JD, the meetup presenter and supposed full-time trader, spends all day trading a system he has not backtested?

Given the content of my blog, this response should sound suspicious. Without solid backtesting and system development behind it, I would never recommend anyone place live trades except in the smallest of size. Without these steps, you have no idea whether the results are fluke or robust and likely to persist into the future. Such a small trading size would hardly fund the mortgage payment every month, which to me casts doubt on this guy’s supposed status as a full-time trader.

Alternatively, he could trade full-time and just make very little money doing it. Perhaps that’s why he sells a service for $79/month?

As mentioned previously, JD spoke long about how option trading can profit in many different ways and he smiled extensively when talking about large profits.

A repetitive application of the big smile was with discussion of option expiration. On two occasions, JD mentioned the statistic that 80% of options expire worthless. Since the presentation focused on net short option strategies, expiring options means profit: something definitely worth smiling about, right? The only problem is that this is a well-known option myth.

Like his dismissal of backtesting, inclusion of this option myth to the presentation makes me suspicious. Did JD think we were all ignorant about option trading? Maybe he thought he was talking to a room full of novices who wouldn’t know any better. Why would he intentionally lie, though, except in an attempt to sell his product? If this was an honest mistake then I would again question his claim as a full-time, 10-year option trader since this is Options 101 level material.

I will continue discussion of this meetup in my next post.

Categories: optionScam.com, System Development | Comments (1) | PermalinkTrader Meetups (Part 10)

Posted by Mark on April 5, 2013 at 06:15 | Last modified: July 25, 2013 12:12Until recently, I had only attended four different meetup groups. In the name of research, I attended a new meetup group on February 28.

This meetup was held at the offices of the sponsoring company. Three of the co-organizers work for this company. The employee who greeted me described the company as “still a startup and many of us pull 14-16-hour shifts, which is why we have this Foosball table and Nerf guns… we like to have fun.” The fourth co-organizer, John Doe (JD for short) works for a sister company. He was the evening’s presenter: a full-time trader who runs a premium service. For $79/month, one can subscribe and get his trades. Several employees (co-founders?) of the startup sat in on the presentation.

The meetup had over 20 attendees, six pizzas, three cases of pop and one case of light beer. Oh–Crazy Bread too! They spared no expense. I would rate the provisions an A+ (red flag… remember what I said about “eat, drink, and be merry?”).

The presentation content was rich in smiles and cool optimism as many winning trades (types) were discussed. JD started by discussing a five-indicator Bollinger Band strategy for intraday scans, which was illustrated using a single chart example. He spent at least 30 minutes analyzing this one profitable trade, which helped to give the chart template a “holy grail” feel (pop quiz: how useful is a sample size of one?). He also talked about other spread trade strategies and smiled liberally when describing profitable endings like 50-100%+ trade returns. Within the first 45 minutes, I really wanted to raise my hand and say “you make option trading sound like an ATM machine.” I exercised staunch restraint.

Given a trade with so many moving parts (five indicators), I did ask JD how he backtested the Bollinger Band strategy. He didn’t. He said that he ran backtesting “a long time ago” but said that he now just runs his intraday scans, places the trades, and makes money.

Does this seem at all suspicious to you? Why or why not?

Categories: optionScam.com | Comments (2) | PermalinkTrader Meetups (Part 9)

Posted by Mark on April 2, 2013 at 05:19 | Last modified: July 25, 2013 12:11In the last post, I mentioned that beginners would not be appropriate for the real trading group. I want to spent a bit more time today talking about beginners.

Goals for the real trading group include sharing ideas with each other, working together to develop actionable trading plans, and holding members accountable for their trading. By definition, beginners have few/no ideas available to share. Beginners do not have actionable trading plans nor may they even know what one is or why it needs to exist. Beginners are not ready for live trading with real money. They have yet to do the laborious work previously described.

For all these reasons, beginners have little to offer the real trading group.

In my opinion, the beginner looking to learn is welcomed with open arms by meetup group organizers with commercial interests. These organizers care most about finding new customers: the greatest sales potential lies in someone who knows the least. By focusing on details of making money without mentioning aspects of risk management or potential loss, a trading seminar can be impressive. If done under the guise of an educational presentation on option basics, the impact may be nothing short of breathtaking.

Unfortunately, this is nowhere near the reality of option trading and is precisely why I feel trader meetups organized by those with commercial interests are optionScam.com. Conflict of interest cannot be ruled out.

Aside from the misleading presentation, I believe invocation of the “eat, drink, and be merry” atmosphere is another leading sales tactic. Get people to celebrate before any hard work has been done. Who wants to do hard work? Beginners don’t realize hard work is a prerequisite to consistent income. Beginners want something easy like a newsletter or e-mail service that tells them what to trade. This is not the road to consistent profits and those who fall prey to such claims will discover themselves optionScammed.com sooner or later.

Categories: optionScam.com | Comments (0) | Permalink