2012 Performance Evaluation (Part 4)

Posted by Mark on February 14, 2013 at 05:34 | Last modified: February 7, 2013 13:12In the last few posts, I have been conducting my 2012 annual review. In the future, this will take only a day or two. Since I have never blogged about it before, however, this time I am reviewing back to inception. I reviewed 2008 and 2009 in http://www.optionfanatic.com/2013/02/13/2012-performance-evaluation-part-3/. Today I will continue with 2010-11.

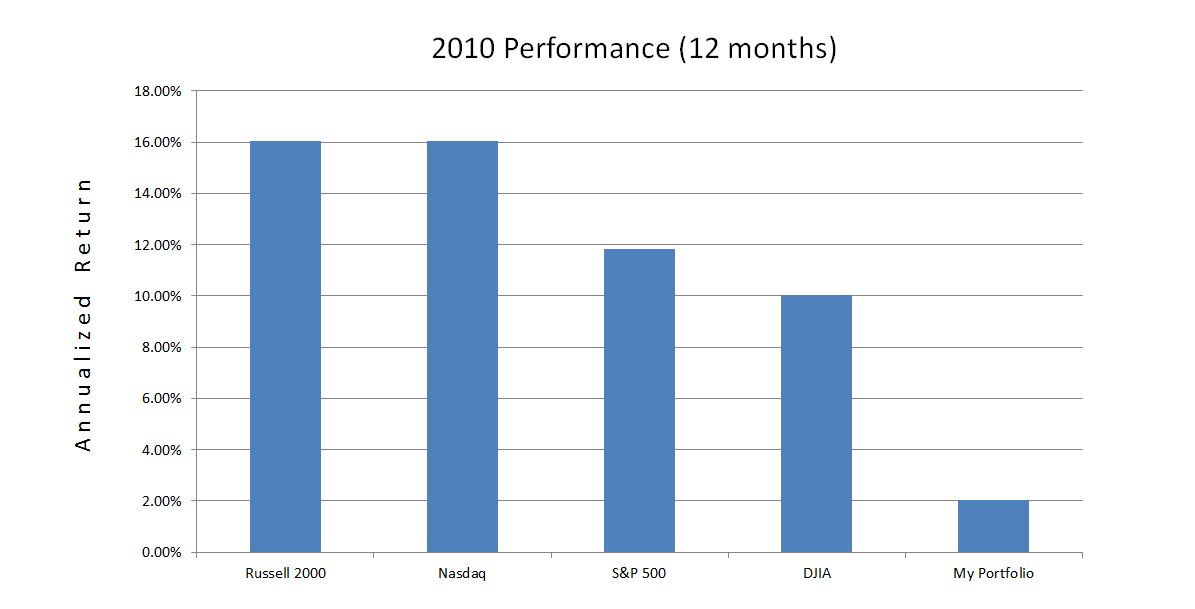

By the numbers, 2010 went like this:

May 6, 2010, was the infamous Flash Crash where the DJIA dropped over 1000 points in one hour. May capped my MDD for the year of 20.5%. In the last post, I said this would be an acceptable annual MDD if it never got any worse. The largest MDD seen in the major indices for 2010 was 13.9% (Russell 2000), though. That makes my MDD seem a bit less heartening.

As market volatility soared from April to May of 2010, my portfolio hemorrhaged cash. The psychic pain became too much to bear on May 6, when I closed the last of my long positions. This may sound familiar because it is: a third time being caught trading too large. As is often the case when trading too large, I was forced out at the absolute worst time (MDD).

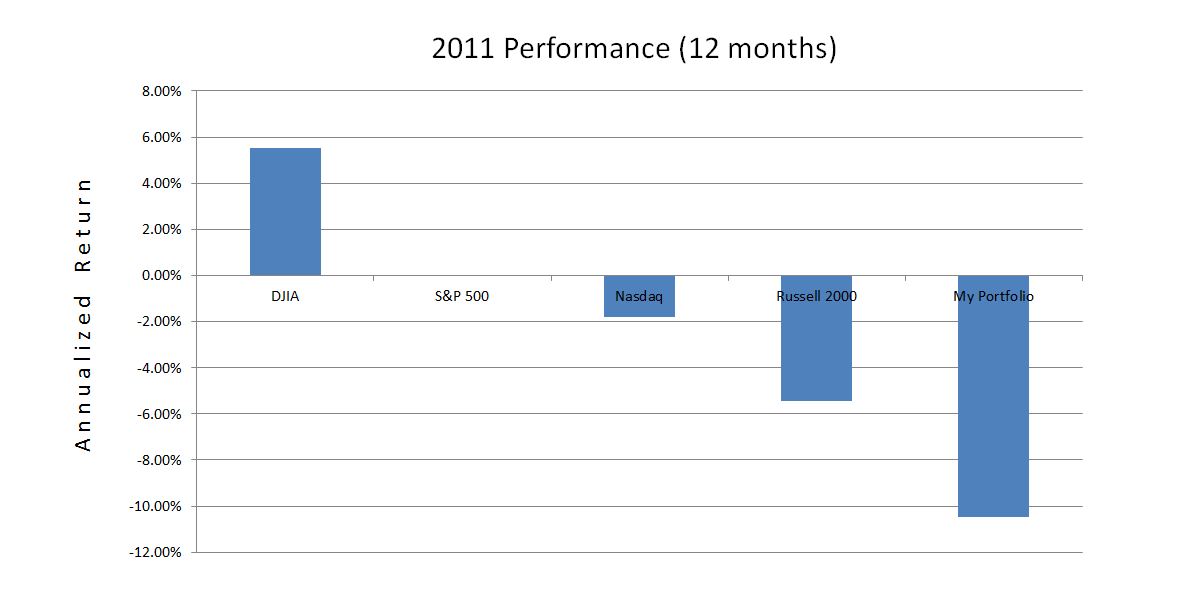

2011 was very similar to 2010:

Again, this year brought a more severe mid-year market crash (Russell 2000 down 24.3% in 2011 vs. 17.1% in 2010 over roughly a 1-month time period), albeit without the magnitude of volatility increase seen during the Flash Crash (volatility spiked 65.2% in 2011 vs. 172% in 2010 over roughly a 1-month time period). I was camping at the time (with my laptop), and was caught with my pants down carrying too large a position for–what time is this? 2007, 2009, 2010… oh yeah, the FOURTH time. In prior posts, I have said that a 20% maximum drawdown (MDD) from one year to the next would be acceptable to me. In 2011, my MDD was 50.1%. Contrast this with the largest broad based index MDD of 25.6% and you have a recipe for disaster.

The analysis will continue with my next post.

Comments (1)

[…] my own boss, I am conducting an annual review in this series of blog posts. In http://www.optionfanatic.com/2013/02/14/2012-performance-evaluation-part-4/, I continued with evaluation of 2010 and 2011. I now want to spend some additional time focusing […]