Truth in Backtesting (Part 9)

Posted by Mark on December 27, 2012 at 03:50 | Last modified: December 7, 2012 18:41I have been describing a layperson’s approach to trading the CDC system on S&P 500 stocks. http://www.optionfanatic.com/2012/12/26/truth-in-backtesting-part-8/ got me to the point where I was encouraged by the system. Now, I need to better understand system exposure.

The truth in backtesting (or lack thereof) exists in the consistency between live trading and tacit backtesting assumptions. Although the backtesting says trading this system could generate a PF of 1.48 for long trades, as written the system requires an account size of $50M and the ability to manage 500 open positions. These are no-can-do for me. Were I to try and execute this system right now then I could expect great difference in live trading performance from that seen in backtesting. Better or worse? Probably worse. This is how markets work and I would be foolish to take a gamble on it.

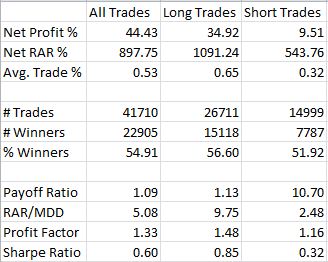

To pin down actual exposure, I first must determine how many open positions the system may require. Were I more skilled at programming then I could code AmiBroker to chart the number of open positions over time. Since I am not, my solution is to decrease the maximum number of allowable open positions in subsequent backtests and watch to see when the performance statistics begin to change. Here are the baseline performance statistics for backtest #21471, which includes the 200-MA filter but not the BB filter:

In backtests #21472 and #21473, I reduced the max number of open positions to 400 and 300 with no change in performance statistics. This tells me no more than 300 open positions were ever seen in the backtest. I was subsequently able to narrow this down between 235-250.

I will continue the analysis in my next post.

Categories: Backtesting, System Development | Comments (1) | Permalink