Truth in Backtesting (Part 8)

Posted by Mark on December 26, 2012 at 05:47 | Last modified: December 7, 2012 16:09In the last couple of posts, I have been taking a layperson’s approach to development of the CDC trading system with S&P 500 stocks. I started with initial backtests in http://www.optionfanatic.com/2012/12/21/truth-in-backtesting-part-6/ and have continued to explore one or two modifications at a time.

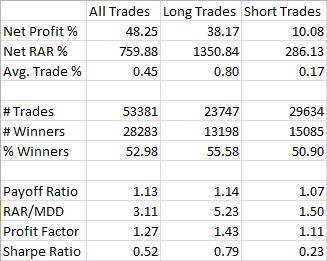

My next step is to exclude the 200-MA filter (or 50-MA filter, which was used in #21468) and see how the system performs with just the BB filter. This is backtest #21469 and should be contrasted to #21467 from http://www.optionfanatic.com/2012/12/24/truth-in-backtesting-part-7/ where just the 200-MA filter was active:

The results are very similar, which means adding either the BB filter or the 200-MA filter similarly improves the efficiency of the system.

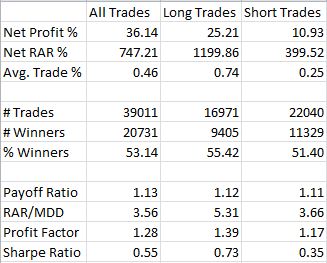

What if the BB filter is modified to make the overbought/oversold condition even stronger? I will now require a close outside the previous BB for the last two bars rather than one. This is backtest #21470:

Compared to #21466 above, the short trades performed slightly better. The other numbers are roughly similar, though. The total number of trades is significantly reduced, which is to be expected, and the long trades still significantly outperform the short trades by a factor of almost three based on average trade %.

By this point I’m somewhat convinced that this system has promise. With tens of thousands of trades over nearly 33 years, this is not a surgical-strike system that trades infrequently and generates gobs of profit on average. This is a system that trades frequently and grinds out smaller profits with each swing.

The next step involves better understanding system exposure. I have been backtesting up to 500 open positions at once and an initial account equity of $50M. Neither of these is realistic because my account is smaller.