Trading System #3–Naked Puts (Part 1)

Posted by Mark on December 6, 2012 at 05:21 | Last modified: November 24, 2012 08:51The words “naked puts” are enough to turn most investors pale white only for the moment before they disappear in a puff of smoke for fear of losing everything. I feel comfortable with naked puts due to several years of live trading and backtesting experience. I would not recommend anybody trade naked puts until and unless they have accrued significant option trading experience along with years of backtesting to become intricately familiar with how they work. I may or may not spend more time writing some educational content later. For now, I want to stick with performance results of this trading system and to start analyzing some implications.

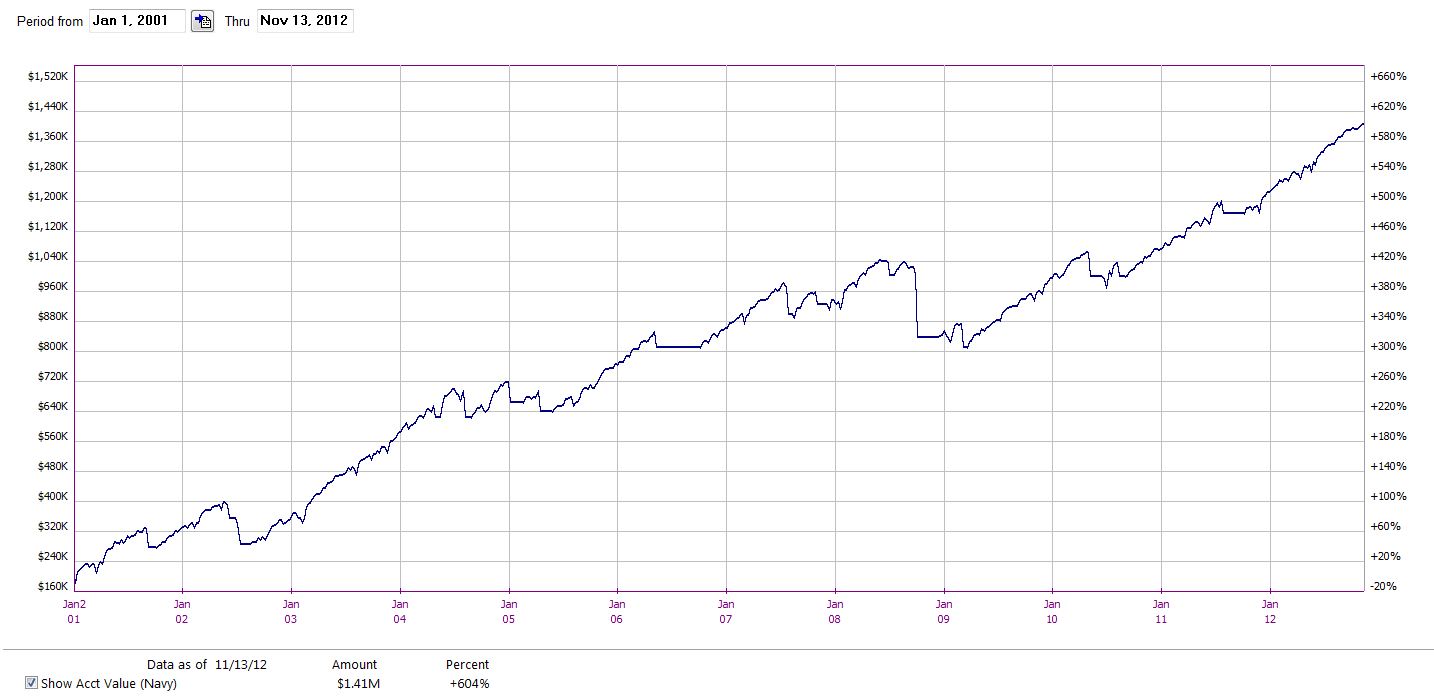

Here is an initial equity curve for the naked puts trading system:

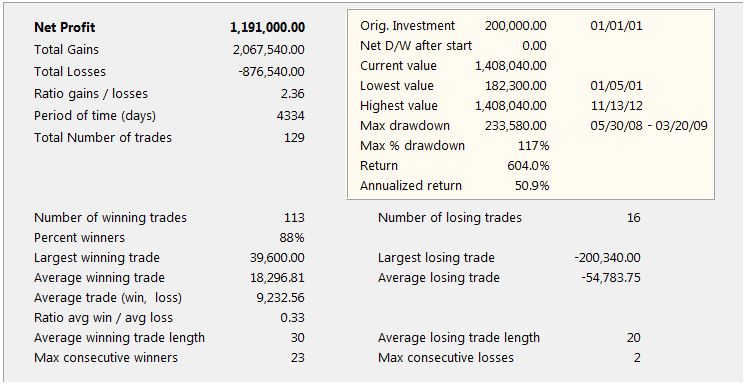

Courtesy OptionVue 7, the initial performance analysis is as follows:

Take a couple minutes and study these numbers. I will begin to delve into the analysis with my next post.

Comments (2)

[…] http://www.optionfanatic.com/2012/12/06/trading-system-3-naked-puts-part-1/, I presented some initial results for the naked puts (NP) trading system. Five years ago when I […]

[…] starting account value should be $1.76M to avoid any DD over 20%. Suddenly, that profit of $1.19M (http://www.optionfanatic.com/2012/12/06/trading-system-3-naked-puts-part-1/) is only 67.8% over 12 years rather than 604%. This amounts to a mediocre annual return of […]