Trading System #2–Consecutive Directional Close (Part 10)

Posted by Mark on November 27, 2012 at 07:27 | Last modified: November 23, 2012 05:34I am currently in the process of backtesting other broad-based indices with the CDC trading system. In http://www.optionfanatic.com/2012/11/23/trading-system-2-consecutive-directional-close-part-9, I backtested QQQ (Nasdaq 100). Today I will backtest IWM (Russell 2000 small caps).

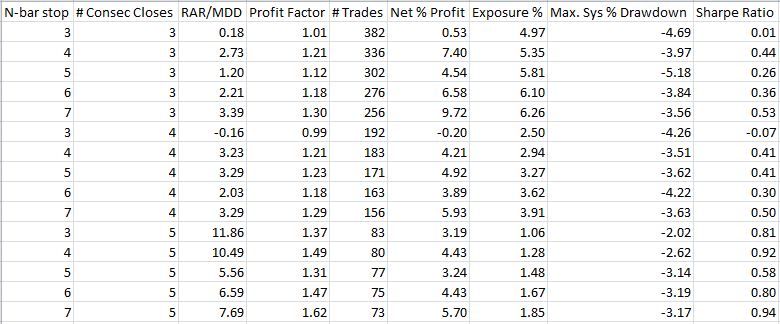

Once again I will backtest x = 3, 4, 5, 6, 7 and N = 3, 4, 5, 6, 7 with a minimum total trades number of 55 (see http://www.optionfanatic.com/2012/11/16/trading-system-2-consecutive-directional-close-part-5). I will include trade delays for buy and short trades with the understanding that any decent results I get may well be improved in live trading. Here are the results as sorted by subjective function (RAR/MDD):

These numbers seem lackluster with a couple systems gaining nothing and most RAR/MDD < 5. As done with SPY and QQQ, I will next backtest long trades only:

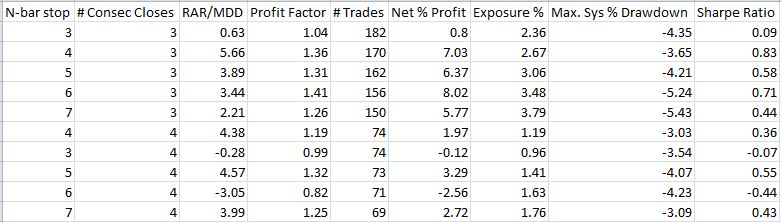

Unlike SPY and QQQ, these numbers are actually worse.

When I see patterns in system development, I really want them to be robust. Why should long-only trades outperform for S&P 500 and Nasdaq stocks but not small caps? I’m sure imaginative types could come up with potential explanations but it makes me skeptical about the pattern since they’re all broad-based indices. If it’s not a real pattern then perhaps I should go back to studying long and short trades together. If the results are not satisfactory for both then perhaps I should waste no more time and move onto the next trading system concept.

This backtesting result has raised many conflicting points worthy of future discussion. I will sleep on it with hopes of a clearer head upon awakening!