Trading System #2–Consecutive Directional Close (Part 7)

Posted by Mark on November 20, 2012 at 06:45 | Last modified: November 2, 2012 11:56Is it realistic to think trade signals for a current day can be known before the close and taken on that day to execute at the closing price? I will discuss this in some detail at a later date. Today, I want to incorporate trade delays with the backtesting from http://www.optionfanatic.com/2012/11/19/trading-system-2-consecutive-directional-close-part-6 and see how the results compare.

“No trade delays” means buy, sell, short, and cover signals generated at the close are immediately coupled with trades executed at the closing price. To incorporate trade delays means opening trades (buy and short) will be taken at market open following the signal-generating close.

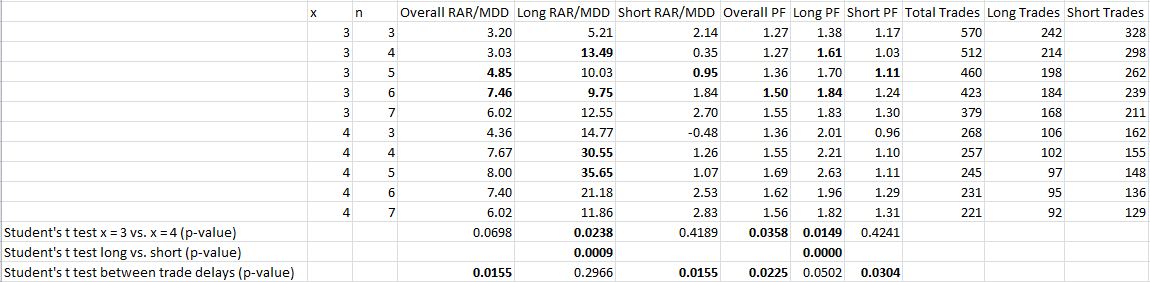

Here are the results of the same backtesting shown in http://www.optionfanatic.com/2012/11/19/trading-system-2-consecutive-directional-close-part-6 with buy and short trade delays included:

In bold are statistics that are better than no trade delays. For the t test rows (bottom three), bold indicates differences for the one-tailed test at the 0.05 significance level.

These results show persistence of the tendencies seen in http://www.optionfanatic.com/2012/11/19/trading-system-2-consecutive-directional-close-part-6. Performance is significantly better for x = 4 than x = 3 although this difference is less pronounced with the trade delays. Long trades perform significantly better than short trades regardless of trade delays.

Finally, performance without trade delays is better than performance with trade delays at the 0.05 level of significance (one-tailed).

My next post will discuss these results in more detail.

Categories: System Development | Comments (0) | Permalink