Trading System #2–Consecutive Directional Close (Part 6)

Posted by Mark on November 19, 2012 at 03:32 | Last modified: October 31, 2012 13:17In http://www.optionfanatic.com/2012/11/16/trading-system-2-consecutive-directional-close-part-5, I settled on x = 4 and n = 5 as a potentially viable combination with which to trade the Consecutive Directional Close (CDC) system. The next step is to study long vs. short trade performance.

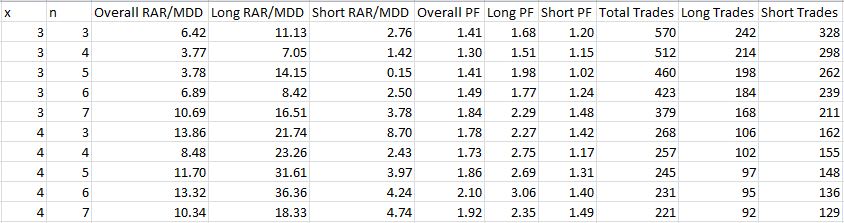

To do this, I used AmiBroker to conduct a series of backtests on the CDC system. I set x = 3, 4 and n = 3, 4, 5, 6, 7, which generated 10 sets of performance statistics:

Note the trends in the data. As the conditions get more extreme (higher values of x and n), total number of trades decreases and profitability generally decreases.

In order to directly compare the long trades vs. short trades, I ran a Student’s t test for independent samples. The results are as conclusive as the table appears:

These miniscule p-values suggest statistically significantly differences between the data.

I will continue future CDC system development with long trades only.

Categories: Backtesting | Comments (3) | Permalink