Position Sizing Implications of Multiple Open Positions (Part 1)

Posted by Mark on November 8, 2012 at 05:03 | Last modified: October 26, 2012 12:42In http://www.optionfanatic.com/2012/11/07/trading-system-2-consecutive-directional-close-part-4, I found sample sizes at the extremes (e.g. x = 5, x = 6, x = 7) too small to be useful in backtesting the Consecutive Directional Close trading system. What if I backtest the component stocks of the S&P 500 rather than SPY itself in an attempt to increase sample size thereby shrinking the error bars and producing more consistent data?

The goal of backtesting all S&P stocks and combining the results is to obtain data similar to trading SPY alone with a sample size large enough to be meaningful and not subject to outlier distortion. To do this, I will have to take every single trade since SPY is the composite of all 500 tickers.

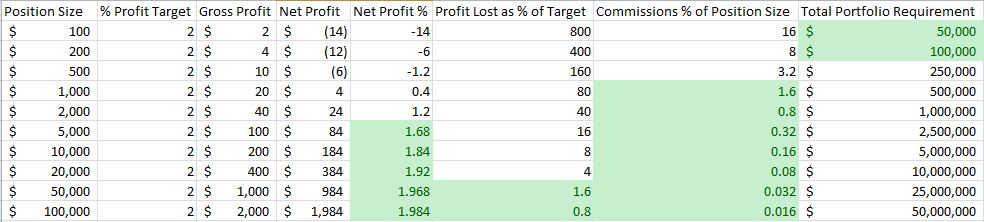

A minimal position size is always required to overcome transaction costs. For example, consider a 2% profit target (reasonable for short-term trades held just a few days) and an $8 commission for each trade:

I can measure commissions as a percentage of profit or as a percentage of position size. Shaded in green are values that I, personally, would deem acceptable for each category. The point is that a minimal position size is required to prevent commissions from cutting too much out of profit thereby rendering the system untradeable. I certainly can’t trade a $500 position size, for example, where commissions alone would wipe out my profit target (and then some). In a complete analysis, slippage should also be considered.

The first problem with trading all S&P 500 stocks is an unrealistic total commitment. The “Total Portfolio Requirement” column above is Position Size x 500 since it is possible to have open trades in all 500 S&P stocks at one time. For most retail traders, this minimum capital required to overcome transaction costs becomes prohibitive long before a sufficiently large position size is reached.

I will continue this discussion in the next post.

Comments (1)

[…] left off http://www.optionfanatic.com/2012/11/08/position-sizing-implications-of-multiple-open-positions-part… discussing total financial commitment as a challenge for trading all S&P 500 stocks in lieu of […]