Redundant Trade Signals (Part 1)

Posted by Mark on November 2, 2012 at 06:06 | Last modified: October 24, 2012 11:27In http://www.optionfanatic.com/2012/11/01/trading-system-2-consecutive-directional-close-part-2, I presented some initial results for the Consecutive Directional Close trading system with x=3 and n=5. Today I will continue discussion of overlooking redundant trade signals.

Redundant trade signals are buy or sell signals that occur once a trade is already open. They may be in the same or opposite direction as the original trade and they may be taken or ignored.

From a statistical perspective, I always wonder whether taking just the first signal in backtesting is biasing the results. If the system backtests profitably and I only took first signals then who isn’t to say in the future, results from the first signal wouldn’t be results from the second, third, or any other signal that may not be profitable? By taking all trades into consideration I might eliminate this bias.

On another hand, results from redundant signals might not be independent of each other. In case of a mean-reversion trading system where redundant signals represent greater and greater stretching of a rubber band likely to snap back to resting state, I would expect additional trades to be more profitable. To backtest only the first signal would therefore understate the results. This would be acceptable because if a backtested system looks good to me when understated then I feel more confident it will do well when traded live.

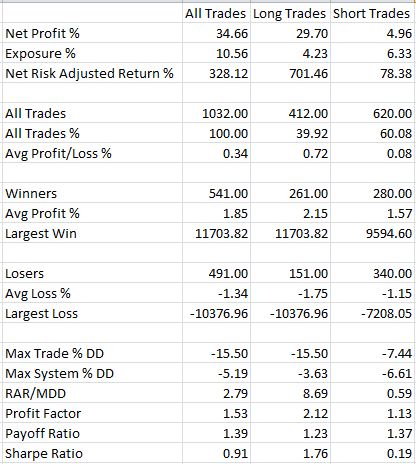

In contrast to Table 1 from my last post, here are the results with x=3 and n=5 when redundant signals are taken:

Total trades have increased from 458 to 1032 and net profit has increased from 13.82% to 34.66%. Short trades have increased to 60% of the total and with max system DD (MDD) up to -6.61% on the short side, the RAR/MDD has decreased from 3.80 to 2.79. Profit factor for longs still dwarfs that of shorts (2.12 to 1.13) so I would lean toward trading this long only if multiple signals were allowed.

I will conclude this discussion with a point about position sizing in the next post.