Trading System #1–SPY VIX (Part 8)

Posted by Mark on October 23, 2012 at 01:41 | Last modified: October 9, 2012 06:53In http://www.optionfanatic.com/2012/10/19/trading-system-1-spy-vix-part-7, I finalized values for y (25%) and z (10). Today, I want to make a final decision on x.

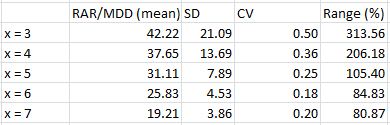

From statistical tables in http://www.optionfanatic.com/2012/10/16/trading-system-1-spy-vix-part-5 and http://www.optionfanatic.com/2012/10/19/trading-system-1-spy-vix-part-7, I have cherrypicked just the rows corresponding to y = 25% and z = 10:

As trade length increases, exposure will increase and RAR will consequently decrease (assuming all else remains equal). This explains the trend lower in RAR/MDD as x increases from three to seven. If I want the most concentrated returns then I should aim for the smallest x-value.

Stability of RAR/MDD across different values of z increases with trade length as evidenced by the trend lower in CV and Range (%) as x increases from three to seven. This suggests I should aim for the largest x-value.

I am favoring x = 5, which will provide a decent RAR/MDD and stability therein.

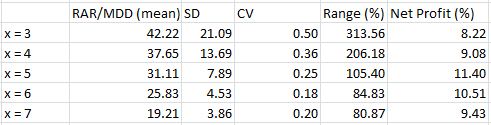

Since RAR/MDD can obscure Net Profit, I want to add one additional column to the above table:

I am somewhat surprised to see Net Profit trail off when x > 5 because the longer the trade, the more opportunity for profit to accumulate. It is possible that after five days mean reversion has occurred and no further edge is available.

The average number of trades for y = 25% is 55.7 (range = 34) across all values of z. This is not a large sample size. If it weren’t for the preponderance of positive numbers across all 150 systems and the trend toward more concentrated profit at higher y-values then I might abort this system altogether and look for something with more backtesting data.

Given all these considerations, I feel comfortable implementing SPY VIX with x = 5, y = 25%, and z = 10.

Comments (1)

[…] http://www.optionfanatic.com/2012/10/25/trading-system-1-spy-vix-part-9, I presented a MAE graph that damaged any hopes for implementing a protective stop-loss. Today I […]