Trading System #1–SPY VIX (Part 6)

Posted by Mark on October 17, 2012 at 05:50 | Last modified: October 6, 2012 07:18In http://www.optionfanatic.com/2012/10/16/trading-system-1-spy-vix-part-5/, I took a close look at the subjective function RAR/MDD by % extended across moving average length (z). I will continue that analysis today.

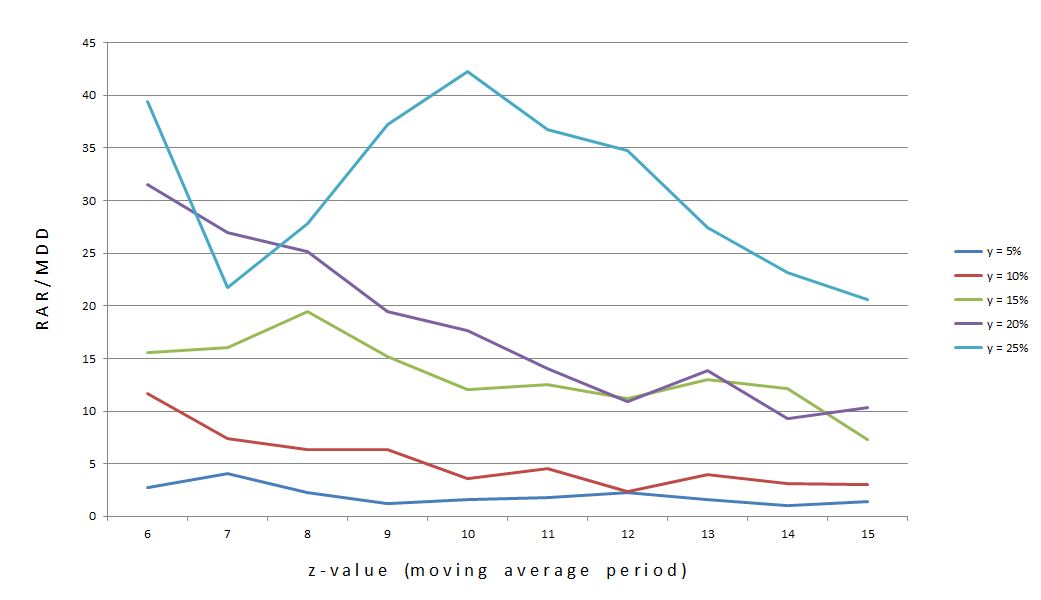

Let me begin by reposting Figure 1 from my last post:

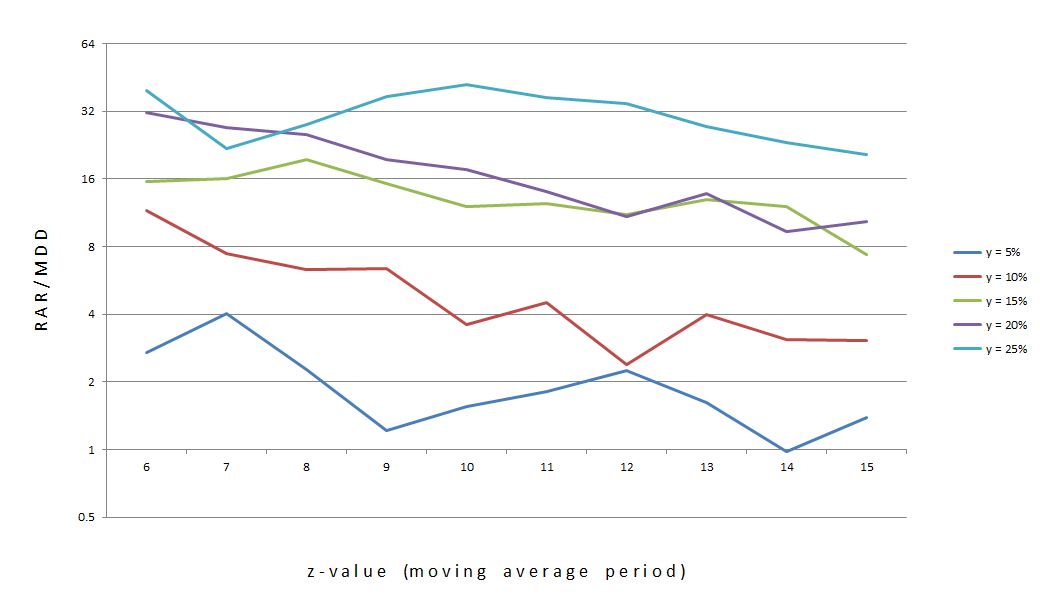

The statistics showed that y = 25% (top curve) is actually the flattest of the five. Perhaps this graph is more convincing:

Do you see the difference? The y-axis is logarithmic in the bottom one, which means any given length represents the same multiplier rather than addend. Each tick on the y-axis multiplies the previous y-value by two rather than adding five. This eliminates distortion caused by widely-ranging (in percentage terms) values.

In addition to choosing y = 25%, I will choose z = 10. This is roughly the center of the middle, high plateau region of the curve.

Going back to Table 1 in http://www.optionfanatic.com/2012/10/16/trading-system-1-spy-vix-part-5/, another observation about these 25% extended systems is the low number of trades. Indeed, a regression analysis shows that total number of trades and % extended are highly correlated (R-squared = 0.8921). On average, these 25% extended systems traded 55 times over 20 years, which is just over 2.5 trades/year.

Despite trading infrequently, these 25% extended systems have been very profitable in the past. Profit factor (PF) is positively correlated with % extended with an R-squared value of 0.7516. The 25% extended systems have the highest average PF of all with an average of 3.13.

To recap, I have 2.5 trades/year x 5 days/trade = 11 days/year and 11 days/year x 1 year / 252 trading days = 4.4%. If I can find 10 more systems that have a good basis for diversification then I can have be invested on roughly 50% of all trade-days (# trades x trading days invested) with good probability for concentrated profits (high PF). A good basis for diversification includes mean-reverting and trend-following systems along with different (non-correlated) asset classes.

I’m not done developing this system, though. In the next post, I will discuss the x-bar stop.

Comments (1)

[…] http://www.optionfanatic.com/2012/10/17/trading-system-1-spy-vix-part-6, I determined that for x = 5, y = 25% produced the best backtesting results for z-values between […]