Trading System #1–SPY VIX (Part 5)

Posted by Mark on October 16, 2012 at 06:40 | Last modified: October 5, 2012 07:07The subjective function is now in hand: RAR/MDD. I will now recreate the results presented in http://www.optionfanatic.com/2012/10/02/trading-system-1-spy-vix-part-3-2 and redo the consequent analysis.

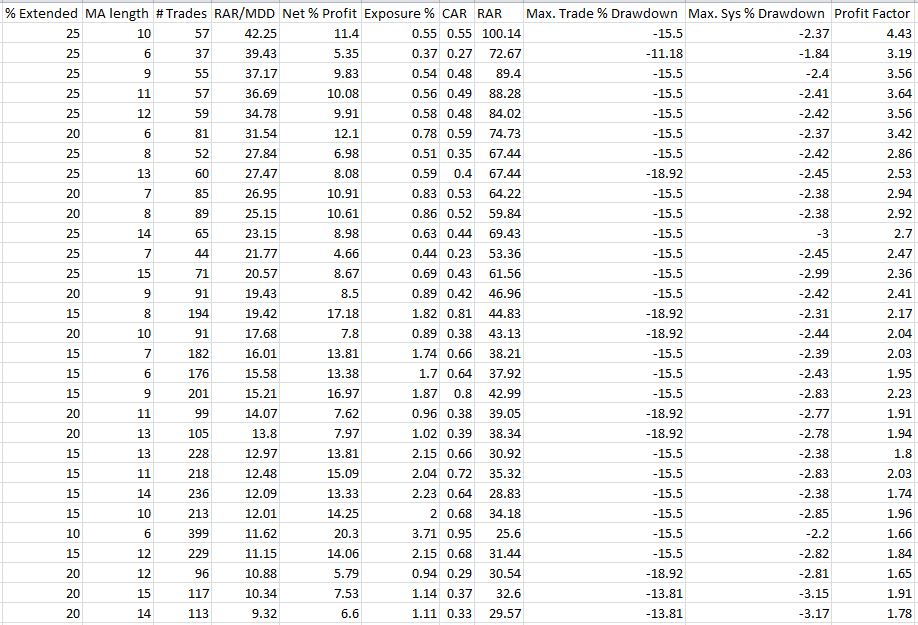

Here are the results for the top 30 parameter combinations as sorted by RAR/MDD:

My first observation is that a cluster of 25% extended systems sit right at the top. Indeed, running a linear regression analysis on all 50 systems shows that % extended and RAR/MDD are correlated with an R-squared value of 0.77 (R-squared > 0.80 is typically considered “strongly correlated”).

This makes logical sense as a mean-reversion trading system. Mean-reversion systems are based on the idea that the farther the rubber band gets stretched, the more likely it is to snap back [to the mean]. The more extended VIX gets above or below the VIX moving average, the more likely SPX is to move higher or lower, respectively. This was also seen [less clearly] in the graph of Net Profit % (http://www.optionfanatic.com/2012/10/03/trading-system-1-spy-vix-part-4/).

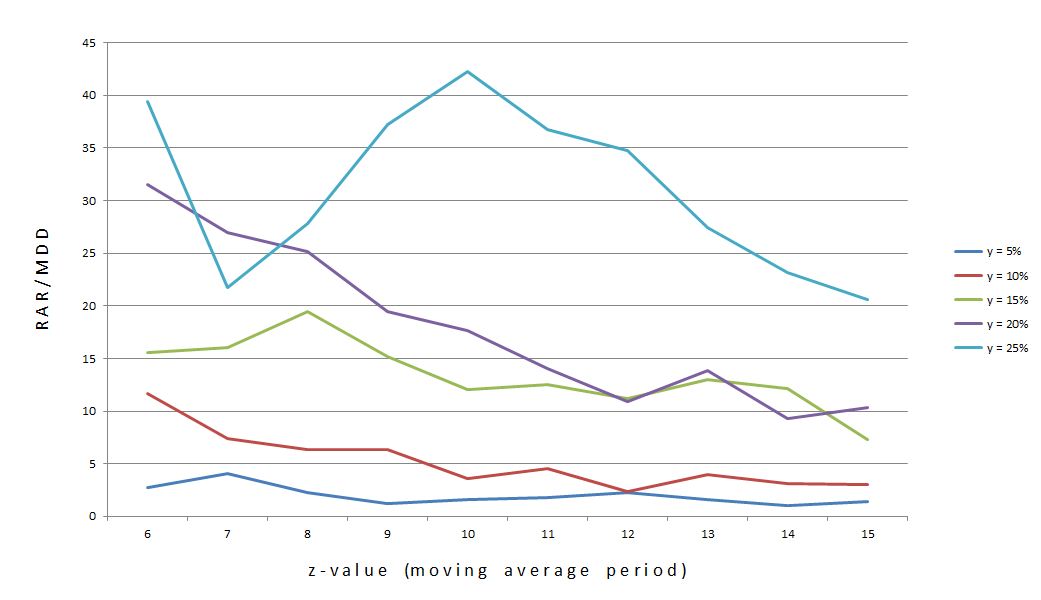

If I break down systems by z-value (moving average period), then the results look like this:

Keeping in mind that I want to see plateau regions rather than spike regions, the bottom curve (y = 5%) looks best. The statistics do not bear this out, however:

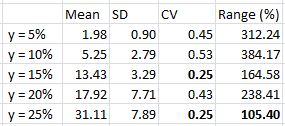

Table 2

Mean = average RAR/MDD

SD = Standard Deviation

CV = Coefficient of Variance (SD / mean)

The lower the SD, the flatter the curve. Even more important is to interpret SD as a percentage of the mean since the means vary over 15-fold. By that metric, y = 25% is the most consistent.

Indeed, y = 25% has a greater RAR/MDD over the entire range of z values. Even the lowest RAR/MDD for y = 25% (at z = 7) is greater than the highest RAR/MDD for y = 15% (at z = 8). Given these observations, y = 25% seems to be the best choice.

I will continue this analysis in the next post.

Categories: Backtesting | Comments (0) | Permalink