Trading System #1–Initial Assessment (Part 6)

Posted by Mark on September 27, 2012 at 06:38 | Last modified: September 21, 2012 06:55In my post http://www.optionfanatic.com/2012/09/25/trading-system-1-initial-assessment-part-5/ (9/25/12), I finished up my analysis of the overbought VIX trading strategy. Today I want to study the claim of avoiding SPY when VIX is oversold, which I described in http://www.optionfanatic.com/2012/09/13/trading-system-1-introduction/ (9/13/12).

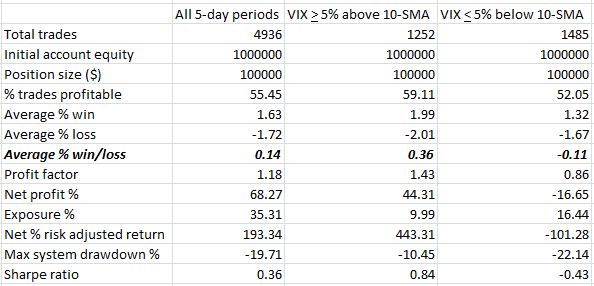

Do 5-day long trades in SPY actually lose money if placed when VIX is over 5% or more below its 10-SMA (“oversold”)? I have included these results in the third column in order to compare with all 5-day SPY trades and 5-day SPY trades only when VIX is “overbought”:

Indeed, the oversold VIX strategy loses money. Average % win is much smaller (1.32%) and the lower % trades profitable (52.05%) contributes to a negative profit factor and negative Sharpe ratio.

Now having substantiated both of the initial claims, I feel more confident about putting forth time and effort to try and develop a trading system. I will continue with these steps in my next post.