Trading System #1–Initial Assessment (Part 2)

Posted by Mark on September 20, 2012 at 05:55 | Last modified: September 21, 2012 06:48In http://www.optionfanatic.com/2012/09/19/trading-system-1-initial-assessment-part-1/ (9/19/12), I presented a table of statistics from the initial backtest of premises for this trading system. Today I will discuss max system drawdown %.

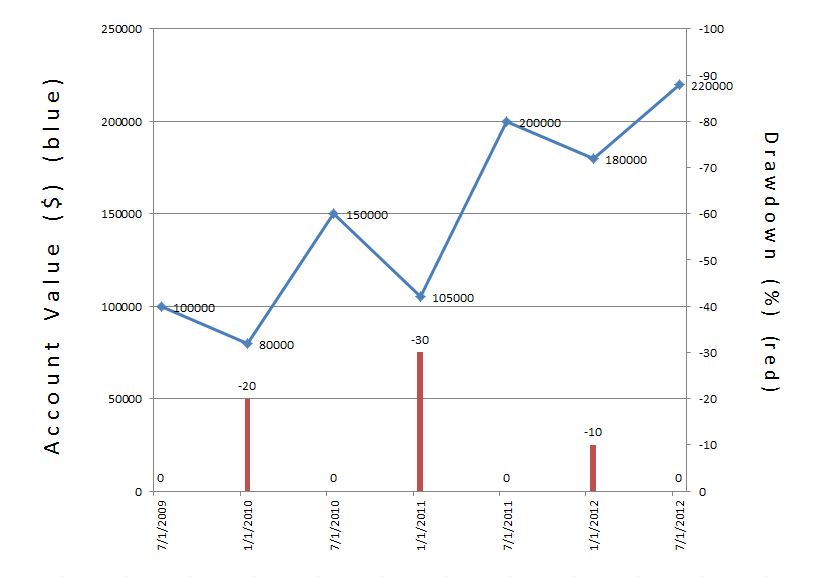

Drawdown (DD) is how much the account has lost from its all-time high. Take a look at the sample equity curve shown below:

The max DD % is -30% on 1/2/11 since the account value had fallen from $150K to $105K.

When assessing a system, it’s important to study DD because this can determine the probability of being able to trade a system consistently over the long-term. Typically, the larger the DD, the greater the Risk of Ruin, the greater the potential profit (think exponential equity curves rather than linear), and the greater the chance you will sell out at the worst time due to fear, sleepless nights, and severe anxiety when losses become largest.

Table 1 from the 9/19/12 blog post shows that when trading every 5-day period, the max DD % was -19.71% vs. -10.45% when buying the S&P 500 only when VIX is at least 5% above its 10-SMA.

This difference, a factor of 1.88, is significant because it can be used to position size the trade. If you are comfortable with a 20% DD then you could trade the “overbought” VIX with nearly twice the position size. Column #3 from Table 1 shows system statistics using a position size of $100K * 1.88 = $188K. Note that the net % risk adjusted return increases from 443.81% to 533.89% primarily from the Exposure increase from 9.99% to 15.97%. Most other system statistics remain the same.

These results are what we should expect given my statement three paragraphs above. Position size increased by 88%. Net profit increased by 92%. The bonus is that although I adjusted position size expecting a proportional in max DD, the latter only increased by 51%. We might be able to trade this system even larger and still remain within our comfort zone.

More on position sizing at a [much] later date.

Categories: Backtesting | Comments (1) | Permalink