Trading System #1–Initial Assessment (Part 1)

Posted by Mark on September 19, 2012 at 08:37 | Last modified: September 21, 2012 06:45In my post http://www.optionfanatic.com/2012/09/14/trading-system-1-backtesting-assumptions/ (9/14/12), I discussed my assumptions for this backtest. I will now proceed with an initial assessment of the claims used to define this strategy.

This part of the system development process is my “Motion to Dismiss.” Think of me as a Defense attorney asking the judge to throw out the entire case because “it’s absurd, Your Honor.” I found these claims on the internet and the internet is often an unreliable source of information. Before I waste time developing a trading system, I want to see if the claims even have merit.

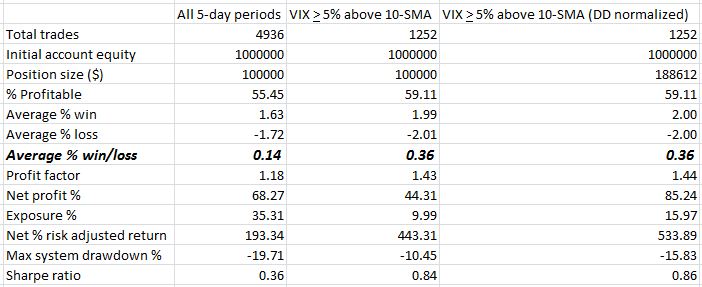

First, let’s take a look at the average 5-day return for SPY vs. 5-day return when VIX is “overbought”:

Table 1

Please ignore the third [“DD normalized”] column for the time being.

Let’s begin the analysis with total trades, net profit %, and exposure %. Realize that the “overbought” VIX condition is more restrictive than “average 5-day return,” which includes one trade beginning every single day. It’s not surprising to therefore see “all 5-day periods” having nearly four times as many trades as the other column. Exposure % measures what percentage of the account is invested during what percentage of time. Position size is fixed here at $100K but where “all 5-day periods” has open trades every day, the other column only trades when the VIX is “overbought.” At first glance, “all 5-day periods” looks impressive with a net profit % of 68.27% vs. 44.31% but don’t overlook the decreased exposure.

“Net % risk adjusted return” equates the two trades by dividing net profit % by exposure %. The result is a hypothetical simulation of both trades being completely in the market at all times. By this measure, buying only when VIX is overbought performs better than buying in general by a factor greater than two.

From a portfolio perspective, focus on the word “hypothetical” two sentences above. Net % risk adjusted return is not a realistic number. Being out of the market much of the time is the nature of the trade. It will therefore generate less profit for you. In order to realize a good profit on of your total portfolio you would need to combine this trading system with other systems to put more of your money at work more of the time.

Categories: Backtesting | Comments (3) | Permalink