Profit with Implied Volatility (Part IV)

Posted by Mark on April 10, 2012 at 08:11 | Last modified: April 10, 2012 08:11In my last post (http://www.optionfanatic.com/2012/04/05/profit-with-implied-volatility-part-iii/), I talked about buying or selling ATM straddles or strangles before earnings to take advantage of big price moves. These big moves may also be used as a pre-earnings trade.

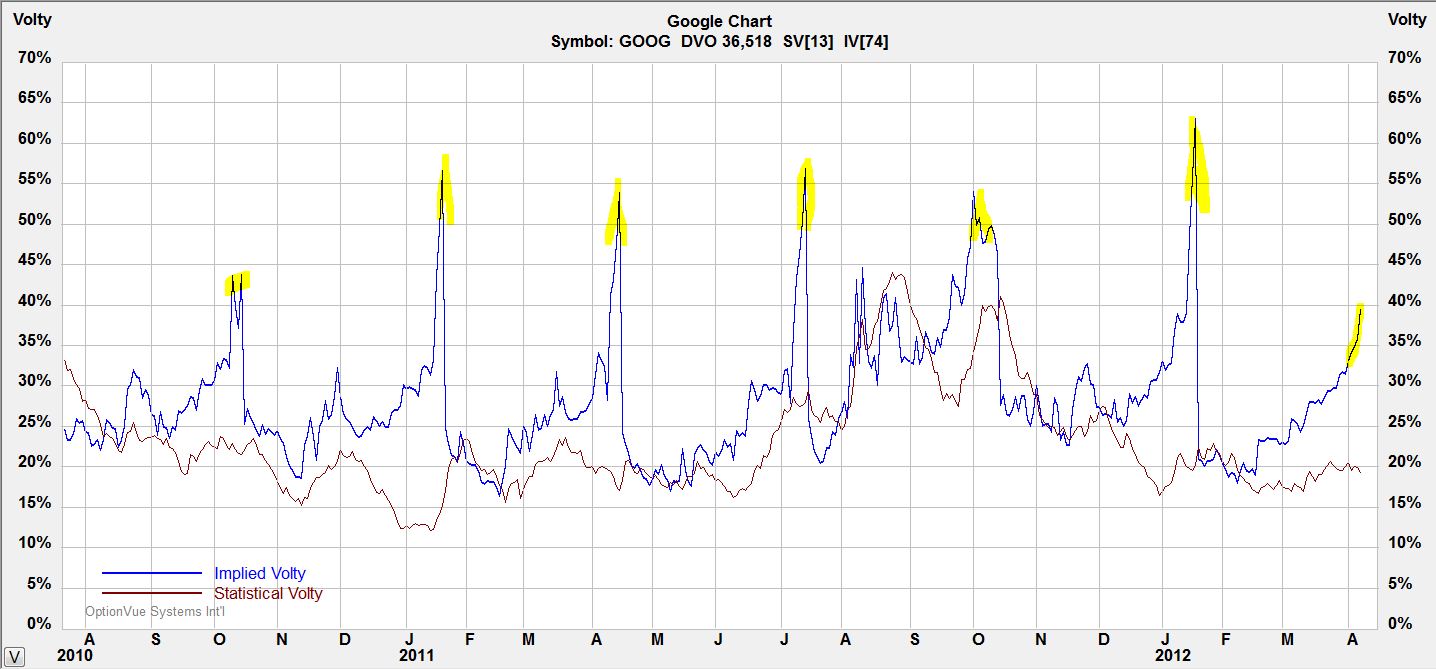

Take a look below at a chart of IV for Google stock (GOOG):

Notice the quarterly IV spikes just before earnings announcements. This is no coincidence since earnings reports are known to cause big moves in stock price.

One way to take advantage of this spike is to buy ATM strangles a few days before earnings and to sell them just before the announcement. Strangles are long volatility; they make money when volatility increases. While options lose money with each passing day (theta decay), money gained from the IV spike will often overcome this decay.

Two guidelines will increase the probability of profiting from this trade. First, look to place this trade on stocks that tend to have big earnings moves. These are the options that will spike largest before the announcement. Second, keep this a very short-term trade. If a company reports earnings after market close on Thursday then you may place the trade on Monday and hold for only a few days. As an example, consider a 4-day trade where options are losing 4% daily due to theta decay. The worst-case scenario would be a loss of 16%. An IV spike of 30-50% or more should offset this.

For January, one GOOG ATM straddle could have been purchased on Tuesday morning for $3,472 with GOOG at $627.72. At 3:30 PM EDT two days later, GOOG was trading at $637.30 and the trade could be closed for a gain of $106 after transaction fees. That’s a gain of 3% in less than three days.

Tags: trader education | Categories: Option Trading | Comments (3) | Permalink